The Federal Energy Regulatory Commission (FERC) has approved Berkshire Hathaway’s (BRK.A) (BRK.B) request to purchase up to 50% stake in Occidental Petroleum (OXY). Warren Buffett’s Berkshire has been slowly increasing its stake in Occidental over the past couple of weeks.

On July 11, Berkshire proposed to the FERC to buy up to 50% of OXY, which was approved last Friday. At the time, the former owned 18.72% of the oil major. Following the news, OXY shares jumped 9.9% to close at $71.29 on August 19.

Propelled by high fuel prices and Berkshire’s interest in the oil driller, Occidental’s stock price has skyrocketed 131% so far this year.

Currently, Berkshire owns a little over 20% in Occidental, but it won’t stop there. If the Oracle of Omaha’s intention is to be presumed, speculators suggest that he will end up buying the whole of Occidental. Buffett has shown his confidence in OXY’s CEO Vicki Hollub on previous occasions, calling her one of the best in business.

As per a WSJ report, both Berkshire Hathaway Energy and Occidental feed the same grid in Louisiana. However, Occidental’s power plant represents only 0.48% of the capacity connected to the region’s grid, and combining with Berkshire “will not have an adverse effect on competition,” the FERC noted.

Carlos D. Clay from the FERC’s Office of Energy Market Regulation added, “It is concluded that the Proposed Transaction is consistent with the public interest.”

Notably, both Berkshire Energy and Occidental’s Oxy Low Carbon Ventures unit have entered majorly into renewable energy, a synergy expected to boost once Berkshire buys Occidental.

Is OXY Stock a Buy Now?

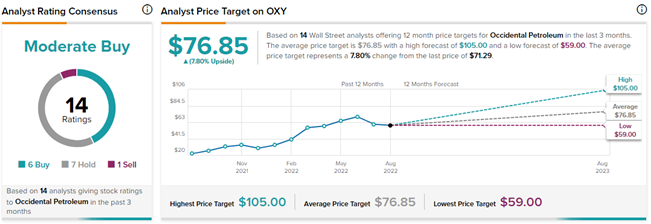

Buffett’s investment choices and long-standing history of making profitable bets surely make for a good investment case in Occidental. Nonetheless, Wall Street analysts remain cautiously optimistic about OXY stock, with a Moderate Buy consensus rating. This is based on six Buys, seven Holds, and one Sell. The average Occidental Petroleum price target of $76.85 implies 7.8% upside potential to current levels.

Moreover, Occidental scores a Perfect 10 on the TipRanks Smart Score Rating system. This implies that the stock is highly likely to outperform market expectations. Financial bloggers’ and News Sentiment is also bullish on the stock. Furthermore, hedge funds have increased their holdings in OXY stock by 18.8 million shares in the last quarter.

Also, TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Occidental, with 4.9% of portfolios tracked by TipRanks increasing their exposure to OXY stock over the past 30 days. All these factors point to a very positive outlook for Occidental stock’s trajectory.