Benefitfocus forecasted lower-than-expected sales in the first quarter after 4Q results topped consensus estimates. Shares of the software company increased 1.7% on March 8 to close at $14.24.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Benefitfocus’ (BNFT) 4Q adjusted earnings tripled to $0.18 per share on a year-over-year basis and beat the Street estimates of $0.05 per share. Revenues declined 13% to $76.2 million but outpaced analysts’ expectations of $74.83 million.

The company’s software services revenue decreased 9% year-over-year to $62.3 million in the quarter, driven by a drop in subscription and platform revenues. Professional services revenue came in at $13.9 million, down 26%. Additionally, adjusted EBITDA was $20.2 million, compared to $12.5 million reported in the prior-year quarter.

Benefitfocus CEO Steve Swad said, “To drive future growth, we are focused on simplifying the enrollment of benefits, improving our customers’ engagement with their benefits, and using data to personalize our offerings and create products that lower health care costs.”

For 2021, the company projects revenue to be in the range of $254 million to $260 million, versus analysts’ expectations of $276.75 million. Adjusted EBITDA is expected to be in the range of $44 million to $50 million.

For the first quarter of 2021, revenue is expected to be between $59 million and $61 million, versus the consensus estimate of $64 million. Adjusted net loss is anticipated to be in the range of $0.16 to $0.10 per share, versus the $0.12 loss per share estimated by analysts. (See Benefitfocus stock analysis on TipRanks)

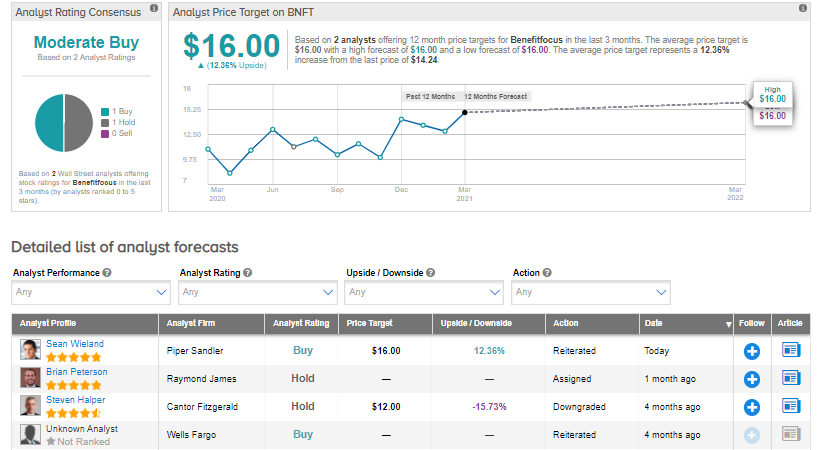

Following the 4Q results, Piper Sandler analyst Sean Wieland trimmed the stock’s price target to $16 (12.4% upside potential) from $20 and reiterated a Buy rating.

In a note to investors, the analyst said, “A disappointing outlook overshadowed the company’s solid Q4 beat.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 1 Buy versus 1 Hold. The average analyst price target of $16 implies 12.4% upside potential to current levels. Shares have increased 31% over the past year.

Related News:

Hibbett 4Q Profit Exceeds Estimates As E-commerce Sales Boom; Shares Tank 4%

Big Lots’ 4Q Profit Beats Analysts’ Estimates As Comparable Sales Rise; Shares Gain 2%

Cooper’s 1Q Results Beat The Street Consensus; Street Says Buy