Bed Bath & Beyond reported 4Q earnings that beat analysts’ expectations but revenues declined year-on-year. The retailer posted net sales of $2.62 billion, down 16% year-on-year versus analysts’ estimates of $2.63 billion. The company reported net EPS of $0.40, that came in ahead of consensus estimates of $0.31 per share.

Bed Bath & Beyond’s (BBBY) President and CEO, Mark Tritton said, “Fiscal 2020 was a year of fast-paced transformation in which we reformed the past, overcame extraordinary circumstances of the present, and established a firm foundation for the future. Despite the challenges created by the COVID-19 pandemic, we relentlessly focused on taking purposeful and bold steps to transform our entire organization and remained true to our plans to rebuild our authority in Home and restore this iconic Company.”

The company’s comparable sales indicated a rise for the third consecutive quarter, with strong digital growth of around 86% and enterprise comparable sales increasing 4% in 4Q. However, comparable store sales declined by 20% as a result of permanent store closures and BBBY divesting some of its non-core banner businesses.

The 12% uptick in digital comparable sales was driven by the Bedding, Bath, Kitchen Food Prep, Bedding, Home Organization, and Indoor Décor categories.

BBBY also reaffirmed its financial outlook for FY21 and expects to clock net sales of between $8 billion and $8.2 billion and adjusted EBITDA to range between $500 million and $525 million. The company also said that it will ramp up its three-year share buyback program from $825 million to $1 billion.

For the fiscal first quarter, BBBY expects net sales to increase by over 40% year-on-year. Excluding the impact from the divestiture of non-core banner businesses, BBBY expects sales to grow higher by around 65% to 70%.

In 1Q, the company anticipates adjusted gross margin to be around 34% and adjusted EBITDA to land between $80 million to $90 million. (See Bed Bath & Beyond stock analysis on TipRanks)

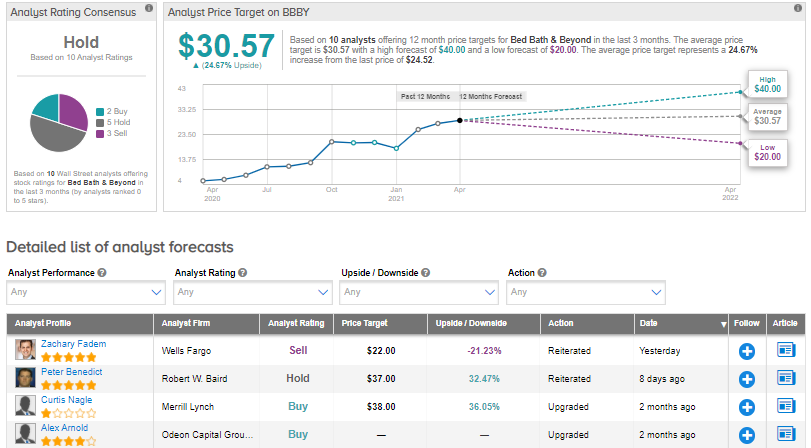

Following the earnings, Wells Fargo analyst Zachary Fadem reiterated a Sell rating and a price target of $22 on the stock. Fadem said in a research note, “While BBBY delivered slightly better results vs. our model, our key takeaway today is that the company continues to cede share during the most prolific home goods/furnishings selling period in recent history…”

“BBBY is certainly making progress, it is difficult to delineate this progress between company initiatives and the environment. While Q1 sets up for impressive top line growth with core sales likely tracking +65%-70% on a -49% compare, we believe the jury is still out on company initiatives, yet shares/valuation, in our view, reflect considerable go-forward improvement,” Fadem added.

Overall, the Street is sidelined on the stock with a Hold consensus rating based on 2 Buys, 5 Holds, and 3 Sells. The average analyst price target of $30.57 implies an upside potential of about 24.7% to current levels.

Related News:

Lovesac 4Q Results Beat Estimates; Street Says Buy

Public Storage Snaps Up ezStorage For $1.8B

Gilead’s Bladder Cancer Drug Trodelvy Gets FDA Nod

Questions or Comments about the article? Write to editor@tipranks.com