For a while, things were looking brighter for Ulta Beauty (ULTA) as it came out of the pandemic era with a vengeance. As people could go out again, Ulta Beauty became relied upon once more for improving looks in a return to socializing. But the tables have once again turned amid industry headwinds, and Ulta Beauty is down nearly 2% in Wednesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Ulta Beauty stuck by its earlier projections for the fiscal year, looking for net sales between $11 billion and $11.2 billion. Comparable sales, meanwhile, will either hold flat or slip by about 2%. At the same time, earnings per share are expected to be between $22.60 and $23.50 per share. All of this comes after a cut in the full-year forecast back in August and a recent earnings miss.

Basically, Ulta Beauty is looking at a more challenging environment than it initially expected. With customers’ wallets increasingly strained by soaring prices on almost everything and the economy as a whole looking for a serious recession for the first time in a while, customers are pinching pennies all up and down the scale. That, in turn, directly and indirectly impacts the beauty products market, as customers have fewer places to go and fewer reasons to dress up when they do go.

Not Taking This Lying Down

But Ulta Beauty, for its part, is not circling its own wagons here. In fact, it seems to be looking for brighter days ahead. The company released plans for not only huge new store openings over the next three years but also to buy back some stock.

Ulta revealed a $3 billion buyback program and announced that it will add 200 new stores to its roster in that three-year span. It wants to drive a big new loyalty program as well, getting up to 50 million members total by 2028. It also means to open up into “new customer segments,” which will be accomplished by pulling in new and established brands alike under its corporate umbrella and offering a “distinct service offering.”

Is Ulta Beauty Stock a Buy?

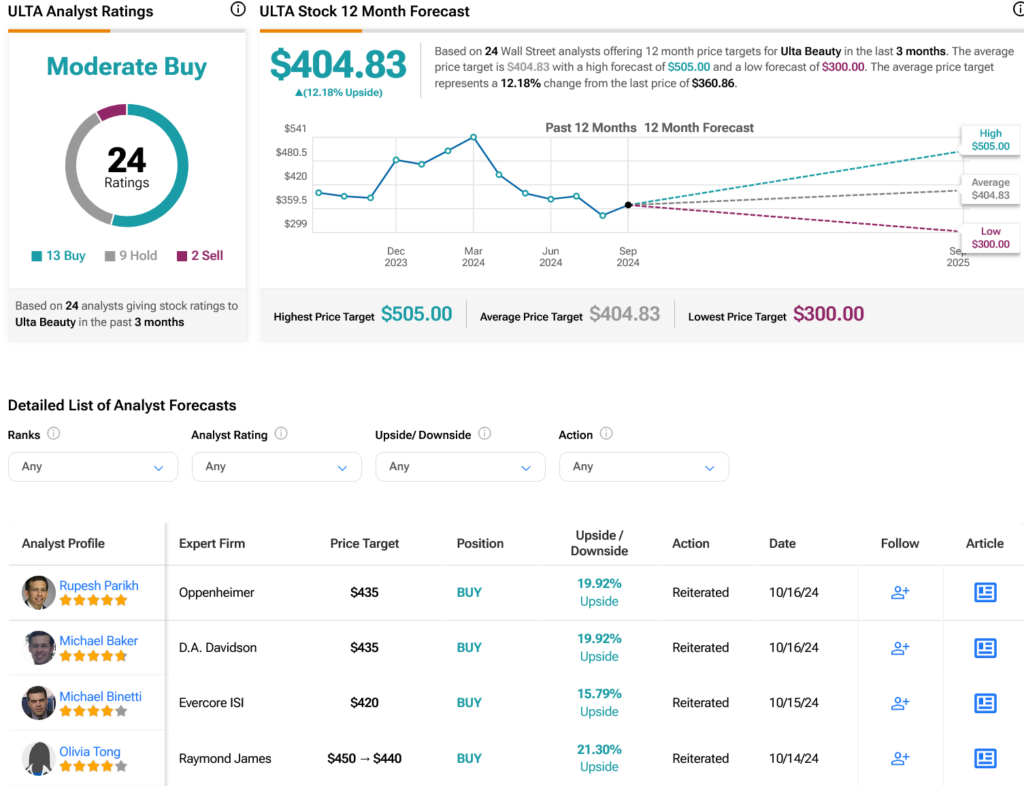

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ULTA stock based on 13 Buys, nine Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 7.15% loss in its share price over the past year, the average ULTA price target of $404.83 per share implies 12.18% upside potential.