Beam Therapeutics (BEAM) is at the forefront of gene editing, a revolutionary medical technology that is drawing significant interest from investors worldwide due to its immense potential for treating genetic disorders. This groundbreaking approach could redefine treatment for over 7,000 genetic diseases caused by mutations or irregular genetic material. The financial implications of gene editing are promising, with the market expected to reach nearly $30 billion by 2032, representing a more than fourfold increase from today’s valuation of $7 billion.

The company is actively developing gene therapies for conditions such as sickle cell disease, beta-thalassemia, severe alpha-1 antitrypsin deficiency, and certain types of leukemia. Analysts are closely watching Beam’s forthcoming sickle cell data for the potential efficacy of the company’s groundbreaking base editing work. Despite lackluster performance this year, successful trial results could dramatically alter the stock’s financial trajectory.

Beam’s Robust Pipeline

Beam Therapeutics is a biotech company developing precision genetic treatments for patients afflicted with severe diseases. The company is managing a pipeline of potential therapies that include BEAM-101, BEAM-302, BEAM-201, and BEAM-301, aimed at treating sickle cell disease and beta-thalassemia, severe alpha-1 antitrypsin deficiency, refractory T-cell acute lymphoblastic leukemia/T cell lymphoblastic lymphoma, and glycogen storage disease 1a, respectively.

The company recently reached several significant milestones. It received clearance from the U.S. FDA for the Investigational New Drug Application for BEAM-301 in GSDIa. Additionally, over 20 patients have been enrolled, with six patients dosed in the BEACON Phase 1/2 Trial for BEAM-101 in Severe Sickle Cell Disease. The first patient has also been dosed in the Phase 1/2 trial of BEAM-302 for Alpha-1 Antitrypsin Deficiency (AATD).

The company is also involved in several research collaborations with pharmaceutical giants such as Pfizer Inc., Apellis Pharmaceuticals, Verve Therapeutics, Inc., Sana Biotechnology, Inc., and Orbital Therapeutics.

Analysis of Beam’s Recent Financial Results

The company recently reported its Q2 2024 financial results. Revenue of $11.77 million fell short of analyst expectations of $13.73 million. Research & Development spending reached $87.0 million, a decrease from $97.6 million in the same period the previous year. Conversely, General & Administrative expenses increased from $24.7 million in Q2 2023 to $29.6 million. The net loss for the quarter stood at $91.1 million, or $1.11 per share, compared to $82.8 million, or $1.08 per share, in Q2 2023. This slightly exceeded the analyst forecast of -$1.14 EPS.

The company’s financial position as of June 30, 2024, included cash, cash equivalents, and marketable securities worth $1.0 billion, a reduction from $1.2 billion at the end of 2023. Beam anticipates that its current assets will sufficiently fund the company’s predicted operating costs and capital expenditure needs until 2027.

Is BEAM a Buy?

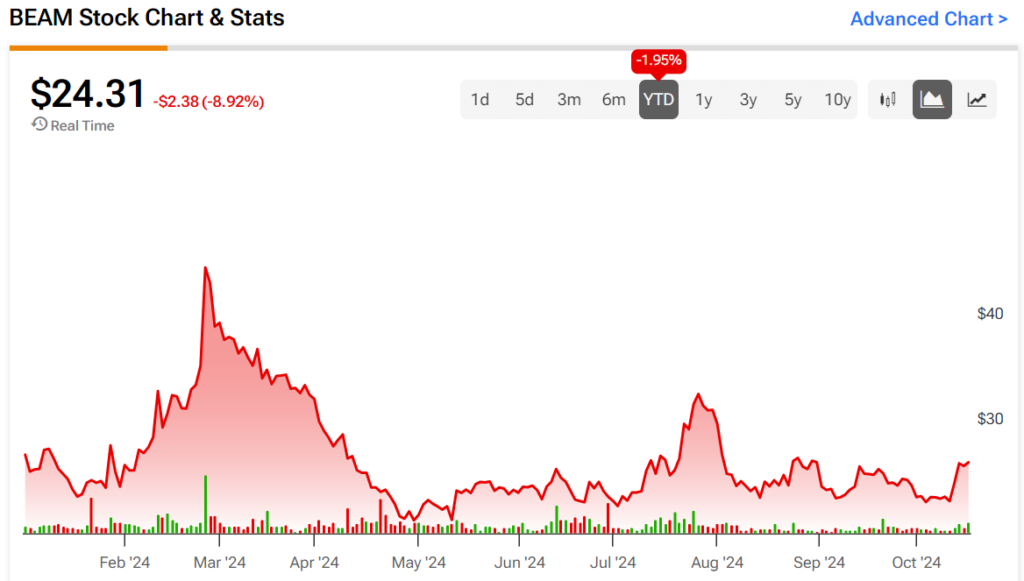

The stock has been on an extended downtrend, shedding over 70% in the past three years. It trades near the low end of its 52-week price range of $16.95 – $49.50, though it shows positive price momentum by trading above its 20-day (24.56) and 50-day (24.93) moving averages. Its P/B ratio of 2.4x appears to be a discount to industry peers in the Biotechnology industry, where the average P/B ratio is 5.25x.

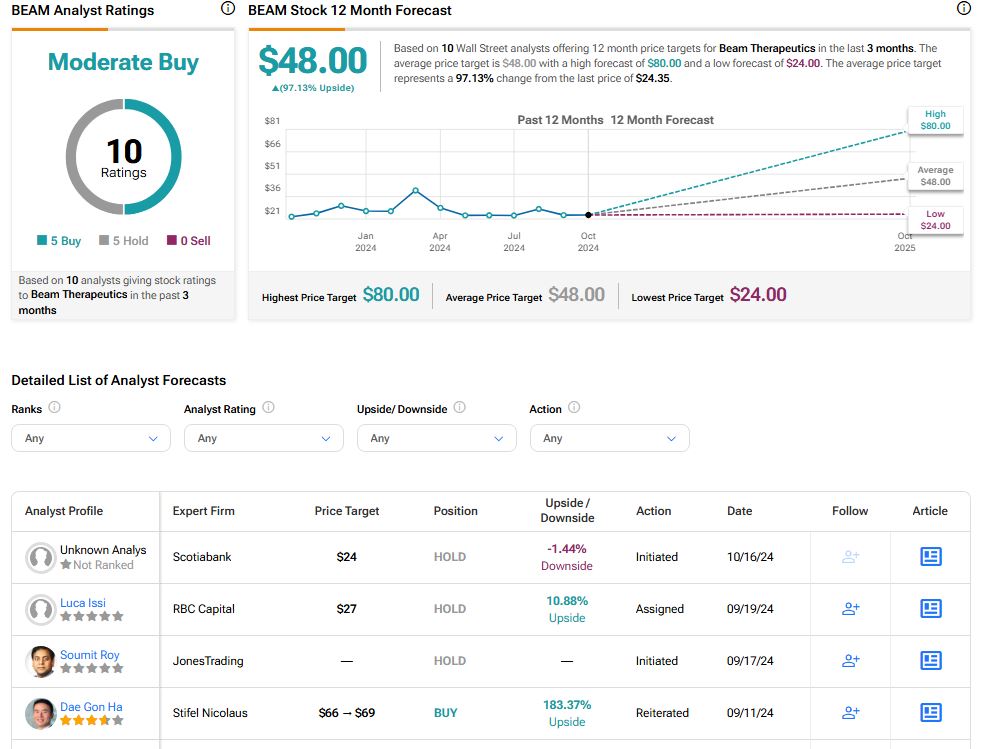

Analysts following the company have been cautiously optimistic about the stock. For instance, Stifel analyst Dae Gon Ha recently reiterated a Buy rating and lifted the share price target to $69, highlighting recent industry data showing positive results and de-risking DNA editing approaches like Beam’s.

Based on ten analysts’ recent recommendations, Beam Therapeutics is rated a Moderate Buy overall. The average price target for BEAM stock is $48.00, which represents a potential upside of 97.13% from current levels.

Bottom Line on BEAM

Beam holds strong potential with its pioneering pipeline, which includes treatments for severe diseases such as sickle cell, beta-thalassemia, severe alpha-1 antitrypsin deficiency, and certain types of leukemia. Despite a downward trend in the stock, positive trial results could significantly transform the company’s financial future.

Further, a recent collaboration with pharmaceutical leaders and the expansion of their clinical trials show promising advancements. Although the latest quarterly results didn’t meet analyst expectations, the company’s robust financial status ensures self-sustaining operations until 2027. The stock looks to be trading at a relative discount, offering a potential upside for investors willing to take on a high-risk, high-reward clinical-stage biotech.