Bath & Body Works (BBWI), the purveyor of personal care products and favorite fragrances, came up smelling like roses (mostly), beating expectations for third-quarter results. Thorny issues with geopolitical challenges impacting international sales aside, robust growth has prompted management to boost full-year guidance, helping to drive the stock up over 18% in the past month. The company has demonstrated financial stability with improved balance sheets marked by reduced debt and manageable repayment timelines.

The stock appears relatively undervalued – suggesting possible further upside for investors. Given its leadership in a niche category and growth opportunities in new and existing markets, it offers investors an appealing aromatic option in the retail space.

Bath & Body Works Attracting the Younger Generation

With over 1,880 company-owned stores in the U.S. and Canada, Bath & Body Works leads globally in the personal care and home fragrance market. It offers various products such as fragrance mists, body lotions, soaps, sanitizers, and 3-wick candles.

As malls have faced declining foot traffic and have dwindled in number, the company has been transitioning away from being purely mall-based. In 2023, it had 115 total real estate projects, consisting of about 90 new off-mall stores.

The company has also worked to shed its image as a destination of choice for mall-bound soccer moms by rolling out Everyday Luxuries, a new product line targeting younger customers. This line has shown promising potential for long-term growth in the Fine Fragrance Mist sector.

Collaborations have also been a key growth strategy, contributing to brand awareness and attracting younger customers. For instance, the continuation of the Stranger Things collaboration and an Emily in Paris cross-category collaboration have generated excitement.

Bath & Body Works’ Recent Financial Results & Outlook

The company recently reported results for Q3 of 2024. Total net sales of $1.610 billion beat analysts’ expectations while posting a 3.0% year-over-year increase. International net sales fell 11.1% to $69 million, primarily due to conflict-impacted markets in the Middle East, which accounts for about half of the company’s entire international business. Despite these challenges, retail sales performance remained robust in unaffected regions, showcasing double-digit growth year-over-year.

However, international exposure had a roughly 70-basis-point negative impact on Q3 net sales growth. This contributed to operating income declining to $218 million compared to $221 million in the same period in 2023. Net income came in at $106 million, a fall from the $119 million of the previous year.

As a result, the company experienced a slight decrease in earnings per share, which was $0.49, down from $0.52 in the third quarter of 2023. However, EPS exceeded consensus projections by $0.02.

The company declared a quarterly dividend of $0.20 per share, equating to a dividend yield of 2.23%.

BBWI’s management anticipates a decline in net sales between 6.5% and 4.5% in Q4 2024, partly due to the shifted fiscal calendar. Earnings per share for the quarter are expected to reach between $1.94 and $2.07. Full-year 2024 guidance reflects an anticipated net sales decline between 2.5% and 1.7%. Earnings per share are expected to fall between $3.15 and $3.28.

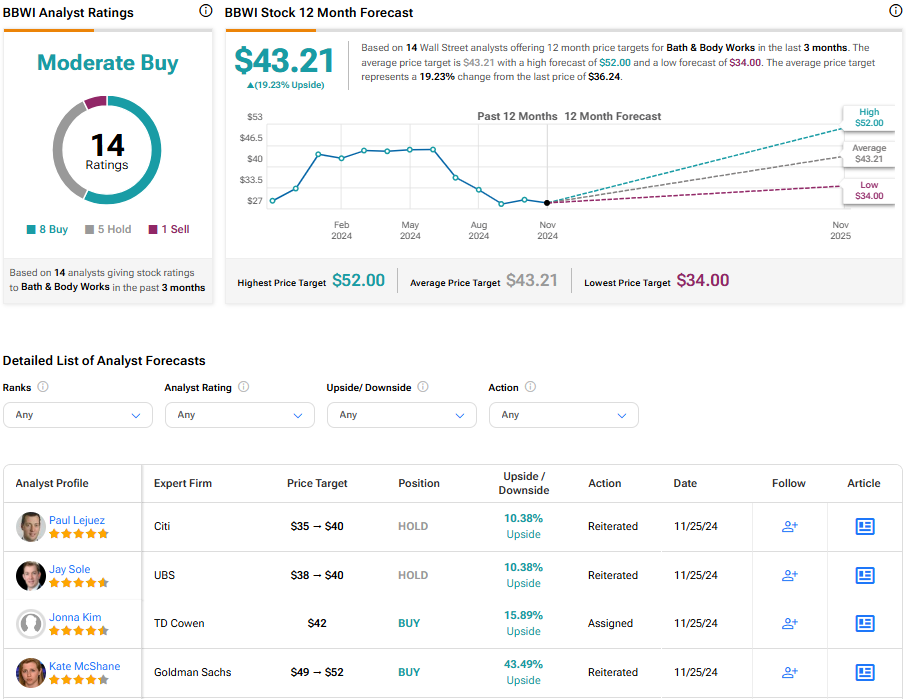

Is BBWI a Buy?

After a rough three-year period that saw the stock decline roughly 50%, it has shown signs of a rebound, climbing over 17% in the past three months. It trades in the lower half of the 52-week price range of $26.21 – $52.99 and shows ongoing positive momentum trading above the 20-day (31.51) and 50-day (31.21) moving averages. Its P/E ratio of 8.75x reflects a significant discount to the Specialty Retail industry average of 18.64x.

Analysts following the company have been mostly bullish on BBWI stock. For example, TD Cowen analyst Jonna Kim reiterated a Buy rating and increased the price target to $42.00 from $40.00, noting the company’s strong performance and growth prospects. Furthermore, Kim believes the potential for growth in FY25, supported by new product launches and increased marketing efforts, makes the stock an attractive buy at its current valuation.

Overall, Bath & Bodyworks is rated a Moderate Buy based on the recommendations from 15 analysts. The average price target for shares of BBWI is $43.13, reflecting a potential upside of 18.36% from current levels.

Bottom Line on BBWI

Despite temporary geopolitical challenges impacting international sales, Bath & Body Works robust growth and expanding prospects in new and existing (younger) markets make the stock a potentially undervalued gem, and investors may want to consider this aromatic investment as part of the retail sector exposure in their portfolio.