The Loulo-Gounkoto mine in Mali is one of Canadian gold mining stock Barrick Gold’s (TSE:ABX) biggest, but it is also proving to be one of its biggest troubles as well. Now, Barrick Gold wants arbitrators to come in and settle its ongoing dispute with the Malian government. Investors did not take the news well, however, and shares were down nearly 2% in Wednesday morning’s trading.

Apparently the huge amount of arrest warrants for top Barrick Gold staffers caught some attention at Barrick Gold proper, because now, Barrick Gold is turning to the International Centre for the Settlement of Investment Disputes. While this may seem largely pointless, it actually is part of the contract that Barrick Gold set up with the Malian government in the beginning, so it may be sufficient to get the job done.

Barrick Gold is hopeful that this will work, and it goes so far as to point out that it has worked before. But with the Malian government eager to wring more tax money out of Barrick Gold, and apparently willing to use its own criminal justice system to get said tax money, it remains to be seen if arbitration will actually work this time.

A Lot at Stake

But in the background lurks the sheer size and scope of the deal. In fact, Barrick has already warned about “significant deterioration” for local conditions in Mali, and notes that it may have to shut the whole thing down altogether.

This would be a blow to Barrick Gold, of course; earlier reports suggest that Barrick Gold took somewhere around 700,000 ounces of gold out of Mali just last year. But Barrick Gold has also invested around $10 billion in Mali since kicking off the mine 29 years ago. And even as this would be a blow to Barrick to lose, the fact that Barrick accounts for between 5% and 10% of Mali’s gross domestic product would be less a blow and more a potential deathblow to the country.

Is Barrick Gold a Buy or Sell?

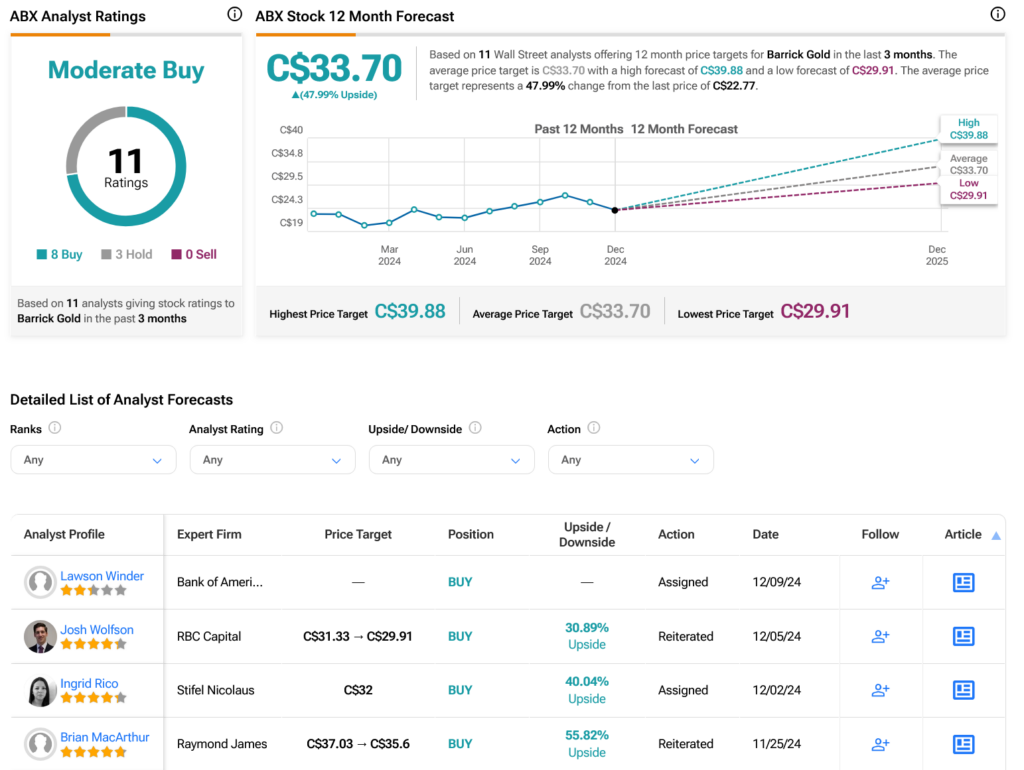

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:ABX stock based on eight Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 3.02% loss in its share price over the past year, the average TSE:ABX price target of C$33.70 per share implies 47.99% upside potential.