For those who follow AMC Entertainment (NYSE:AMC), the news has either been about the APE (NYSE:APE) units or about how theaters in general are doing poorly. However, there was a whole new sign of life from theatres, and they call it “Barbenheimer.” It was enough to send AMC stock up over 7.5% at one point in Monday afternoon’s trading.

Barbenheimer is the colorful name given to the simultaneous release of two summer blockbusters: “Barbie” and “Oppenheimer.” One is about the popular children’s toy line of the same name, and the other is about the theoretical physicist and nuclear weapons figure of the same name. The two films have occupied the top two slots at the box office for the last two weeks, with “Barbie” leading by a wide margin. In fact, the latest numbers for “Barbie” just came back, and astonishingly, “Barbie” made just over $93 million in its second week. That’s largely unheard-of in theaters, and that means a hefty boost to the AMC bottom line, as well as the entire concept of theatrical releases.

The news out of AMC as a result of this dual dynamo of releases was shocking in its own right. Thanks to Barbenheimer, the week of July 21 to July 27 was the highest single-week admissions revenue figure in the entire 103 years that AMC has operated, according to an ABC News report. Moreover, a statement from AMC itself noted that 65 individual locations set their own record for a single-week box office take. The question, of course, is what will AMC do for an encore? Barbenheimer can’t pack them in forever, and when Barbenheimer fades away, will the returns go with it? Or is this a return to the good old days of the theater-going experience?

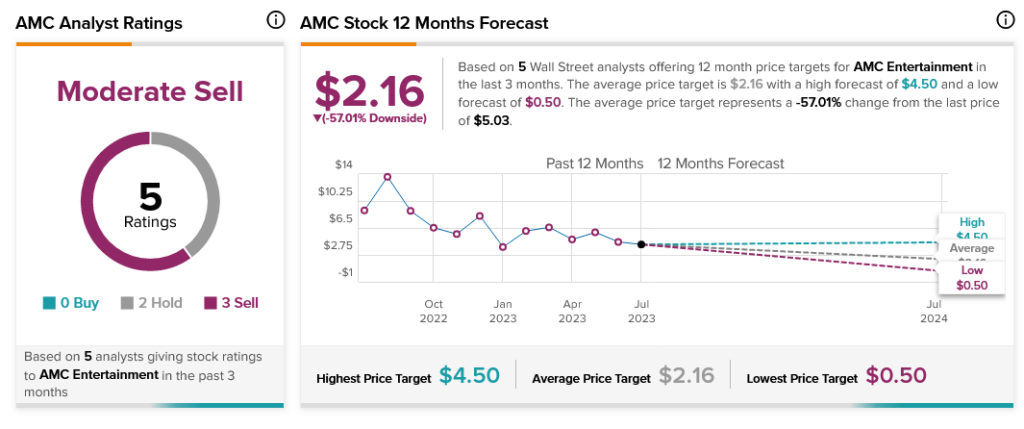

Analysts are skeptical. With two Hold ratings and three Sell ratings, AMC stock is currently rated a Moderate Sell by analyst consensus. Further, AMC stock comes with a 57.01% downside risk thanks to its average price target of $2.16.

Questions or Comments about the article? Write to editor@tipranks.com