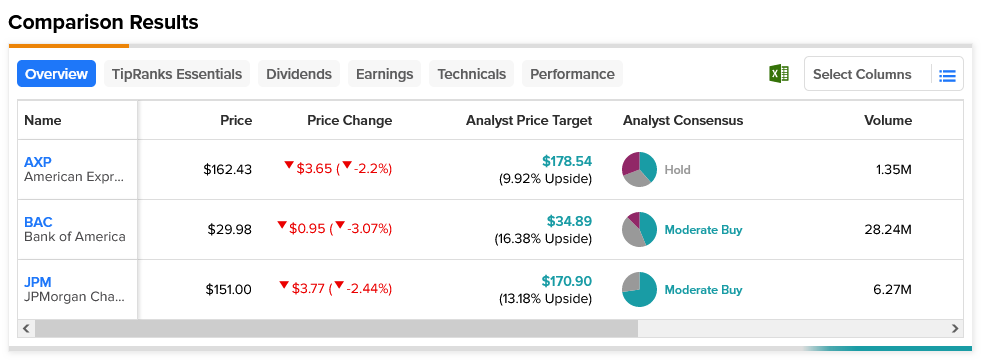

Recent reports from several different banks—including Bank of America (NYSE:BAC), JPMorgan Chase (NYSE:JPM) and American Express (NYSE:AXP)—all offered some downright surprising good news about the state of credit cards in the United States. Calling attention to the comparatively positive state of credit cards didn’t do much good for these bank stocks, however; all three were down in Tuesday afternoon’s trading. Bank of America lost just over 3%, JPMorgan Chase dropped 2.4%, and American Express shed 2.2%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The news was comparatively good, if only by virtue of being not nearly as bad as it might have been. Kind of like when a stock posts a loss in its earnings report, but not as bad of a loss as analysts expected, thus it still turned in a beat. American Express discovered that consumer credit card delinquency rates were sitting around 1.1%. That’s roughly what it was in June 2023, and below the July 2019 rate of 1.4%, which is solid. Meanwhile, net charge-offs were largely unchanged from June 2023 at 1.8%, and down from July 2019’s figure of 2.2%.

Bank of America found similar rates in net charge-offs, though it noted delinquency was up to 1.24% from its June rate of 1.2%. It was lower than the July 2019 rate of 1.57%, however. Bank of America also found lending rates were also mostly flat in July. Finally, JPMorgan Chase saw a slight increase in delinquency, up to 0.89% in July 2023 against 0.88% in June. And both figures were will below the 1.15% figure seen in July 2019. All of this data comes at a noteworthy time for credit cards; for the first time in the United States, U.S. credit card holders have racked up a combined debt of over $1 trillion. Americans are apparently putting simple necessities on their cards as they attempt to deal with soaring, still-high inflation.

The numbers did the banks little good. Yet the bank hit the hardest, Bank of America, is a better overall prospect. It’s rated a Moderate Buy, and with an average price target of $34.89, Bank of America stock comes with a 16.38% upside. Meanwhile, American Express took the lightest hit, but it’s merely a Hold for analysts. Further, its average price target of $178.54 only gives it a 9.92% upside potential.