Several bank stocks are surging today on news of Donald Trump’s victory. The former president is expected to significantly roll back regulations across many industries, including the financial sector. Most banking stocks are in the green today, including Goldman Sachs (GS), JPMorgan Chase (JPM), and Bank of America (BAC). This suggests that these companies, as well as their peers, will benefit from Trump’s time in office over the coming years.

Financial Sector Stocks Surge

There are multiple sectors expected to rise under Trump, primarily due to his promises to roll back regulations on many industries. Once U.S. markets stabilize and adjust to the impending change in government, many companies in the financial sector will likely rise even more as momentum builds for Trump’s policies.

Leading today’s charge is Goldman Sachs, currently up 13% for the day, with shares rising steadily. The investment bank surged this morning on news of Trump’s win, following a week of limited price action. GS stock is now up 14% over the past five days and is likely to continue rising on Trump-driven momentum, at least in the short term.

JPMorgan and Bank of America are also rising steadily, with gains of 10% and 7%, respectively. Despite a dip this morning, Wells Fargo (WFC) is also trending and has risen 12% since regaining its momentum. With the U.S. economy preparing for more of Trump’s signature tax cuts and deregulatory policies, banking and financial services stocks are likely to continue trending upward as companies prepare for four years of an economic policy agenda that favors them.

Analysts See Strong Potential in Goldman Sachs Stock

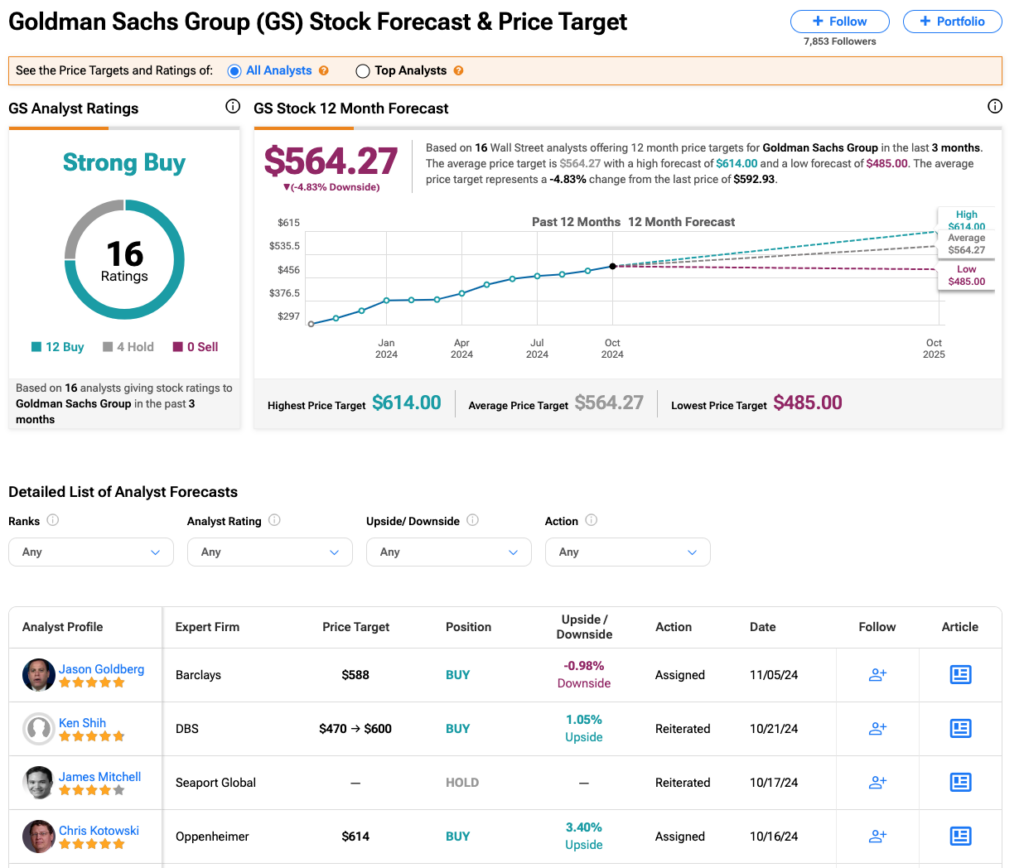

Wall Street is bullish on many banking stocks, particularly Goldman Sachs. Analysts have a Strong Buy consensus rating on GS stock, based on 12 Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. That said, after an 88% rally in its share price over the past year, the average GS price target of $564.27 per share implies 5% downside potential.

See more GS stock analyst ratings

No analysts have issued new ratings or price targets for Goldman Sachs or any of these banking stocks since the announcement of Trump’s victory. However, banks will likely issue more bullish sentiments in the near future in anticipation of the growth they will experience during his presidency.