Sometimes good is not good enough. Advanced Micro Devices (NASDAQ:AMD) posted beats on both the top-and bottom-line in its Q1 readout whilst also meeting Street expectations on its guide. However, investors appeared to want more, sending shares down 9% as of this writing.

The chip giant generated revenue of $5.47 billion in the quarter, amounting to a 2.2% year-over-year increase while edging ahead of the consensus estimate by $20 million. Within the revenue haul, boosted by the launch of its new MI300 accelerators and its Ryzen and EPYC processors, the data center segment’s revenue climbed by 80% y/y to a record $2.3 billion. At the other end of the equation, adj. EPS of $0.62 beat the analysts’ forecast by $0.01.

Looking ahead to Q2, the company is calling for revenue of $5.7 billion, plus or minus $300 million, roughly inline with the Street at $5.69 billion. This amounts to y/y revenue growth of around 6% at the midpoint and quarter-over-quarter growth of roughly 4%.

So, that all sounds quite good, so what exactly were investors disgruntled about? Possibly due to high expectations around MI300 revenues. As it attempts to muscle in on Nvidia’s dominance, CEO Lisa Su said the chip’s sales should exceed $4 billion this year, but that was a relatively tame increase on the firm’s prior guidance of $3.5 billion.

But setting the bar quite low could have its advantages, says Bank of America’s Vivek Arya, a 5-star analyst rated in the top 1% of the Street’s stock pros.

The $4 billion MI300 outlook suggests only a low 4-5% share of the $90-$100 billion accelerator market in CY24E, which management anticipates could increase at a swift CAGR (compound annual growth rate) of 50%+. According to Arya, the company should be able to claim more than that while other parts of the business could also perform well.

“While we do not agree with the extreme bull-case 20% share target given NVDA and ASIC competition, we do expect AMD to be at least 5-10% of the market,” the 5-star analyst said. “Upcoming launch of next-gen MI350 (2H’24 launch, CY25 ramp) could help improve competitive response. Second, AMD continues to gain share against INTC in PC and server CPU, suggesting greater traction in enterprise also. Embedded sales are weak now, but could benefit from same cyclical recovery expected by auto/industrial peers. Overall we see AMD maintaining a 15-20% topline and 25%+ EPS growth trajectory over next few years.”

To this end, Arya rates AMD shares a Buy, although he lowered his price objective from $195 to $185. Nevertheless, there’s still upside of ~29% from current levels. (To watch Arya’s track record, click here)

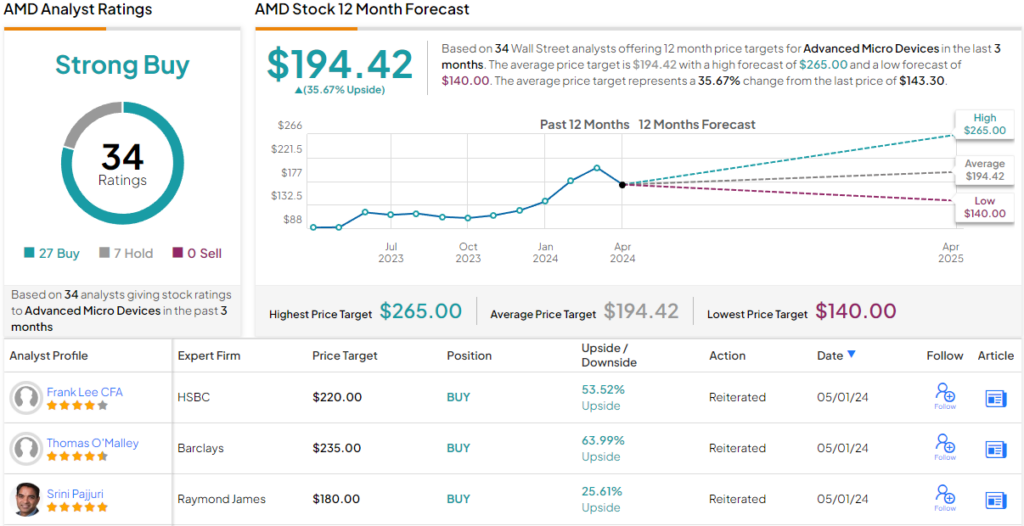

Most of Arya’s colleagues support his thesis. The stock claims a Strong Buy consensus rating, based on a mix of 23 Buy recommendations and 7 Holds. Going by the $194.42 average price target, the shares will appreciate by ~36% over the next year. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.