Berkshire Hathaway’s (NYSE:BRK.B) most recent 13F filing for Q4 2023 revealed some changes in Warren Buffett’s portfolio. The Oracle of Omaha trimmed his Apple (NASDAQ:AAPL) position and took profits on his 2023 investment in homebuilder DR Horton (NYSE:DHI). His second-largest holding, slightly over one billion shares in Bank of America (NYSE:BAC), remained unchanged. Buffett’s 13.12% stake in the company is now valued at around $36.5 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Below, I will highlight the bank’s Q4-2023 results and discuss whether it makes sense to buy the shares. In brief, I am neutral on the stock, with the bank’s Q4 results heavily impacted by specific charges to the tune of $3.7 billion but also revealing underlying weakness across business segments.

Bank of America’s Operational Overview

Bank of America reports results in four main operating segments: Consumer Banking at 46.8% of Q4-2023 revenues, Global Wealth & Investment Management at 23.6%, Global Banking at 26.8%, and Global Markets at 18.6% of revenues (amounts do not round to 100% due to charges incurred in the miscellaneous All Other segment).

These charges totaled $3.7 billion, including $1.6 billion from the termination of the Bloomberg Short-Term Bank Yield Index and $2.1 billion related to the FDIC special assessment. Let’s analyze how these major segments performed.

Consumer Banking recorded a 4.2% year-over-year drop in Q4-2023 revenue, reflecting lower deposit balances. Provisions for credit losses were 49% higher relative to the prior-year quarter, with the increase partly reflecting conservative provisioning (net reserve build of $0.4 billion) but also higher actual net charge-offs (incurred credit losses rose $0.4 billion as well). As a result, the return on average allocated capital was 26% in Q4 2023 (Q4 2022: 35%).

Global Wealth & Investment Management also saw a 3.4% year-over-year revenue decrease in Q4, impacted by lower net interest income. Net assets under management flows were $8.4 billion in Q4 (2023: $52 billion). Costs rose on revenue-related incentives and a higher FDIC expense, bringing the return on average allocated capital to just 22% in the quarter (Q4 2022: 27%).

Global Banking revenue recorded a steep decline of 7.9% in Q4, impacted by lower net interest income and leasing revenue. Good cost control and provision releases helped limit the impact on earnings, with the return on average allocated capital being 20% in Q4 2023 (Q4 2022: 23%).

Global Markets was the only segment to record a revenue increase in Q4, at 5.9%, boosted by higher sales and trading revenue. Costs increased by 3.2% as well, bringing the return on average allocated capital to 6% in Q4 2023 (Q4 2022: 5%).

For the bank as a whole, revenue slipped 10.2% year-over-year in Q4 (full year 2023: +3.8%), impacted by the poor business momentum and extraordinary charges outlined above. The return on tangible shareholders’ equity was 5.9% (2023: 13.5%). Furthermore, diluted EPS was $0.35/share in Q4 and $3.08/share in 2023, both down year-over-year by 58.8% and 3.6%, respectively. Tangible book value per share was $24.46, +2.8% quarter-over-quarter.

While I would not say that all charges incurred in Q4 were extraordinary (banking is inherently a risky business, layered with regulatory charges and ever-changing business dynamics), the magnitude of the $3.7 billion in provisions overwhelmed the underlying profit generation of the bank. That said, the bank clearly lost momentum in the final quarter of the year, as evident from operating segment results. Out of the $0.5/share year-over-year drop in Q4 EPS, only 70% can be attributed to the two specific charges.

Bank of America’s Capital Position and Shareholder Returns

Bank of America’s CET1 ratio (which looks at a bank’s capital relative to assets) finished the year at 11.8%, down 0.1% quarter-over-quarter, reflecting shareholder distributions. With the current 2024 requirement set at 10%, the bank is sitting on a comfortable 1.8% CET1 buffer.

On the conference call, CEO Brian Moynihan emphasized the dividend and internal growth opportunities as the main avenues to deploy the bank’s capital. Given the substantial tangible book value premium Bank of America trades at (about 1.45x tangible book value, to be precise), this capital allocation approach makes sense since emphasizing buybacks would not bring much value to shareholders.

Compared to Citigroup (NYSE:C), Bank of America’s 1.8% CET1 buffer is higher than Citigroup’s 1% CET1 surplus. However, this is already priced into the shares, with Citigroup trading at just 0.66 times its tangible book value. This valuation gap reinforces my neutral stance on Bank of America.

Bank of America’s Commercial Real Estate Exposure

Bank of America has significant exposure to commercial real estate, at 12.3% of all commercial loans or 6.9% of the bank’s total loan portfolio. What’s more, 25% of the total commercial real estate loan portfolio is allocated to the office sector, which has drawn investor scrutiny recently.

I think the sizable commercial real estate exposure is a manageable risk for Bank of America, considering that the expected Federal Reserve rate cuts will ease the strain on the sector. That said, market stress surrounding commercial real estate is still evident, with German lenders specializing in U.S. real estate, such as Deutsche Pfandbriefbank (DB:PBB), trading at just 0.19x their tangible book value compared to 1.45x at Bank of America.

We can say that further losses on Bank of America’s commercial real estate portfolio will undermine the bank’s profitability and are not really priced into Bank of America’s stock price. In a nutshell, Bank of America market valuation does not account for tail risks that may emerge from its commercial real estate exposure.

Interest Rate Outlook and Valuation Relative to Peers

Bank of America derived 57.8% of its 2023 revenue from net interest income, making it one of the more exposed banks to Federal Reserve interest rate cuts. The markets currently project a ~1% cut to the Fed funds rate by December 2024, which Bank of America estimates will decrease its net interest income by $3.1 billion on an annualized basis (or about 3.1% of 2023 revenue).

Bank of America’s closest sector peer ETF is the SPDR S&P Bank ETF (NYSE:KBE), which tracks bank stocks in the S&P Total Market Index. The KBE ETF currently trades at a price-to-book ratio of 1.09x and a P/E ratio of 9.86x, at a discount to Bank of America’s valuation (P/E of 11.5x). That said, largest peers with higher profitability, such as JPMorgan (NYSE:JPM), trade at a price-to-tangible-book ratio of 2.18x, implying upside potential for Bank of America if profitability is improved.

Given the deteriorating operating momentum observed in Q4, though, bridging the gap with JPMorgan is unlikely to happen soon.

Is Bank of America Stock a Buy, According to Analysts?

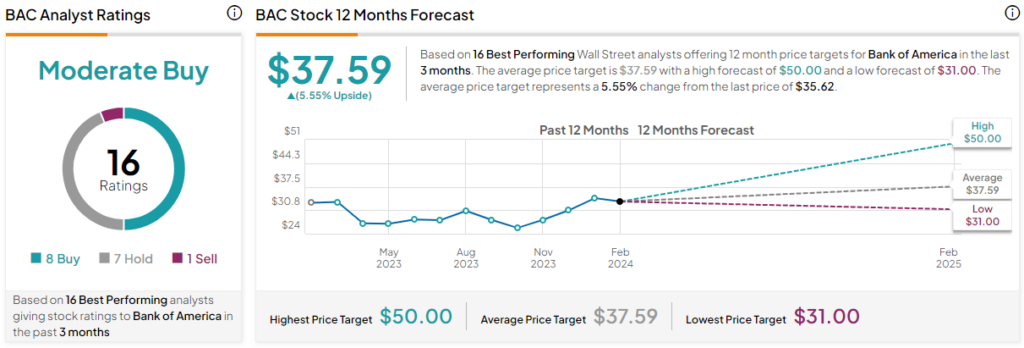

Turning to Wall Street, Bank of America earns a Moderate Buy consensus rating based on eight Buys, seven Holds, and one Sell rating assigned in the past three months. Additionally, Bank of America stock’s average price target is $37.59, implying 5.6% upside potential.

The Takeaway

Bank of America’s Q4-2023 results were primarily impacted by idiosyncratic charges but also showed lackluster business momentum. As such, considering the bank’s elevated valuation in terms of tangible book value and uncertain business prospects, coupled with commercial real estate tail risks, I am neutral on the shares and expect them to perform in line with the banking sector average.

The key thing to watch in the upcoming Q1-2024 report is whether Bank of America regains its operational momentum, which can help it bridge the valuation gap with sector peers such as JPMorgan (NYSE:JPM).