It’s that time of year again when public companies start dialing in their latest quarterly results, and next week some of Wall Street’s biggest names will enter the fray. Hardly any come bigger than Alphabet (NASDAQ:GOOGL), and next Thursday (April 25), once the market action concludes, the world’s 4th most valuable company will deliver its Q1 statement.

Ahead of the print, Bank of America analyst Justin Post offers a positive take.

“We see upside potential to Street 1Q revenue estimates, as checks suggest search stability and YouTube strength, plus the Leap Year/Easter benefit,” said the analyst ranked amongst the top 1% on Wall Street given the accuracy of his stock predictions. “We think search could grow 13% vs Street at 11%, while Street has YouTube growth decelerating 1pt q/q, which has upside given META/PINS outlooks.”

Specifically, Post sees Search generating $45 billion compared to the Street’s estimate of $44.8 billion, YouTube revenues of $7.8 billion, just slightly above the Street’s projection of $7.7 billion, Cloud at $9.3 billion, and Network at $7.5 billion, both in line with consensus.

At the other end of the spectrum, Post sees Q1 core margins falling by 45bps year-over-year to 34.6%, Opex at $23.1 billion (compared to the Street’s $22.9 billion), and GAAP EPS of $1.48 vs. consensus at $1.50. Due to “ongoing restructuring & limited job postings,” Post expects upside to forward estimates.

Coincidentally, just like the prior earnings readout, Microsoft reports on the same day, of which Post notes that “reporting same day has not been positive for Google AI sentiment.”

That’s an interesting quirk as the Q1 readout comes at a time when questions have been raised about GOOGL’s positioning in the AI game.

“AI use does pose long-term competitive risks for Google,” says the 5-star analyst, “but in 2024 Google (and peers) are likely to see AI monetization improvements.”

Considering the outlooks of peers, Post believes that the consensus for Q1 estimates has “too much deceleration.” Post sees solid search results as potentially serving as the “2nd catalyst for recovery in AI sentiment following March lows.” Additionally, Google’s annual developer conference, Google I/O, is scheduled for May.

Furthermore, Post thinks there are other ways for GOOGL to help its own case here. An update on the CFO situation, further cost cutting actions, or a dividend announcement could all be opportunities “for the stock to surprise.”

All told, Post rates GOOGL shares a Buy, along with a $173 price objective, implying the stock has room for 11% growth over the next year. (To watch Post’s track record, click here)

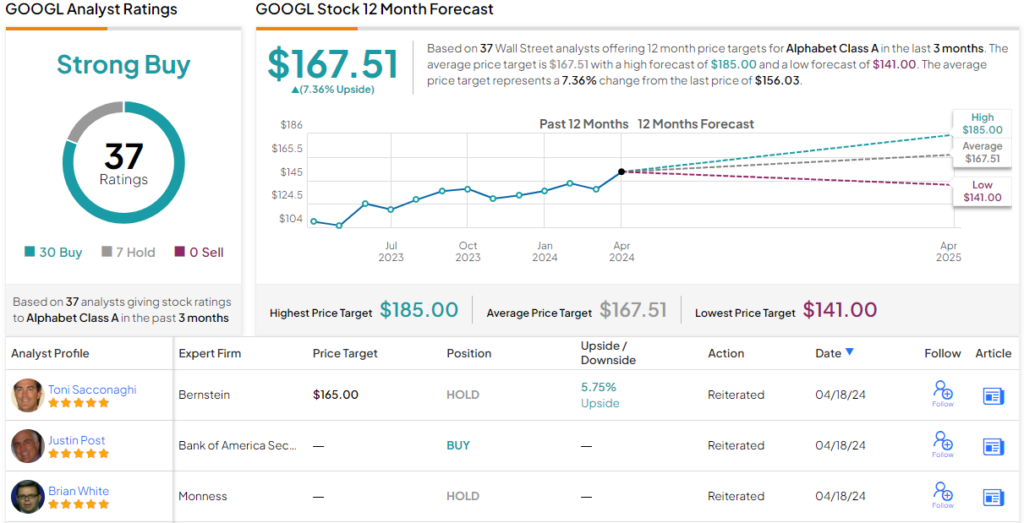

It’s clear that Wall Street generally agrees with the Bank of America take on GOOGL. The stock has 37 recent reviews, which include 30 Buys and 7 Holds, giving the stock its Strong Buy consensus rating. The share price is $156.03, and the average target of $167.51 indicates room for ~7% growth in the year ahead. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.