Bank of America (BA) suggests selling stocks when the Federal Reserve starts cutting interest rates, as there’s a growing chance the U.S. economy might slow down sharply. This advice came from strategist Michael Hartnett after U.S. stock indices like the S&P 500 (SPY) dropped following a jobs report that showed a big slowdown in hiring. Plus, the ISM Manufacturing PMI fell for the fourth month in a row.

Hartnett said it’s a good idea to sell after the first rate cut because the risk of a “hard landing” (a recession) is rising, even though many fund managers expect the economy to have a soft landing (falling inflation with no recession).

He noted that the connection between job growth and manufacturing activity is a warning sign. The only other time manufacturing contracted without job losses was from September 1984 to April 1986. July’s jobs report showed only 114K new jobs, much lower than the 178K expected.

Interestingly, Bank of America put out a report last week saying that the “Magnificent Seven” stocks were only a bad jobs report away from a major drop. Although today’s trading action isn’t really considered a major drop–except for Amazon (AMZN), which is mostly down because of its earnings results–it was caused by a weak jobs report and could potentially be the start of a bear market. In fact, the Nasdaq (QQQ) is now in correction territory, meaning it’s down more than 10% from its high.

Which Magnificent Seven Stock Is the Best Buy?

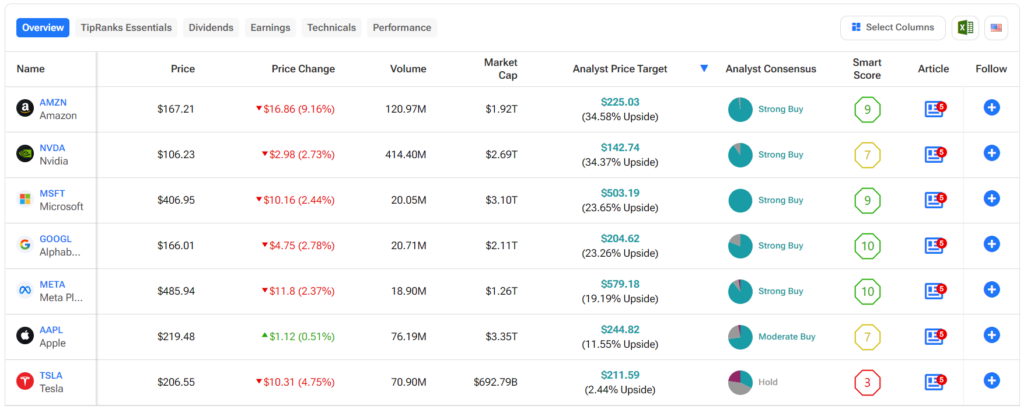

Of the Magnificent Seven stocks—Amazon, Alphabet (GOOGL), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA)—analysts expect the most upside potential from AMZN. In fact, its $225.03 per share price target implies over 34.58% upside potential.