Advanced Micro Devices (AMD), more commonly known as AMD, is a powerhouse in the chip sector, and it just made some new gains thanks to a little support from Bank of America Securities. The analyst pick gave AMD a little extra boost, up over 1.5% in Thursday afternoon’s trading.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Bank of America Securities analyst Vivek Arya came out with positive word for AMD, though perhaps not as positive as it might have been. Arya revealed that Nvidia (NVDA) and Broadcom (AVGO) were still top picks in the artificial intelligence microchip space, but AMD made unexpected gains with its standard CPU chip.

Normally, this field would be dominated by Intel (INTC), but AMD has been rapidly gaining, and now has the potential to take quite a bit of market share from Intel. Intel has been in the grip of a lot of reorganization efforts of late, including its ongoing move to improve its foundry operations, which has in turn left it a bit more vulnerable to outside attempts to seize market share.

A Potential Win for Gamers?

AMD also has another card up its sleeve that might prove a major draw in the PC gaming market. Its new frame generation technology has just emerged, and with it, it might be possible to improve frames per second rates in more games. Frames per second are one of the biggest measures of graphics quality; the more frames per second are involved, the smoother the presentation.

Known as Fluid Motion Frames 2, or AFMF 2, the system got a technical preview back in July, but is now currently available. It works similarly to Nvidia’s DLSS Frame Generation system, but actually works at the driver level, which opens up more potential games that it can work with. That might give it a real edge, especially given Nvidia’s primacy in the graphics space.

Is AMD Stock a Good Buy Right Now?

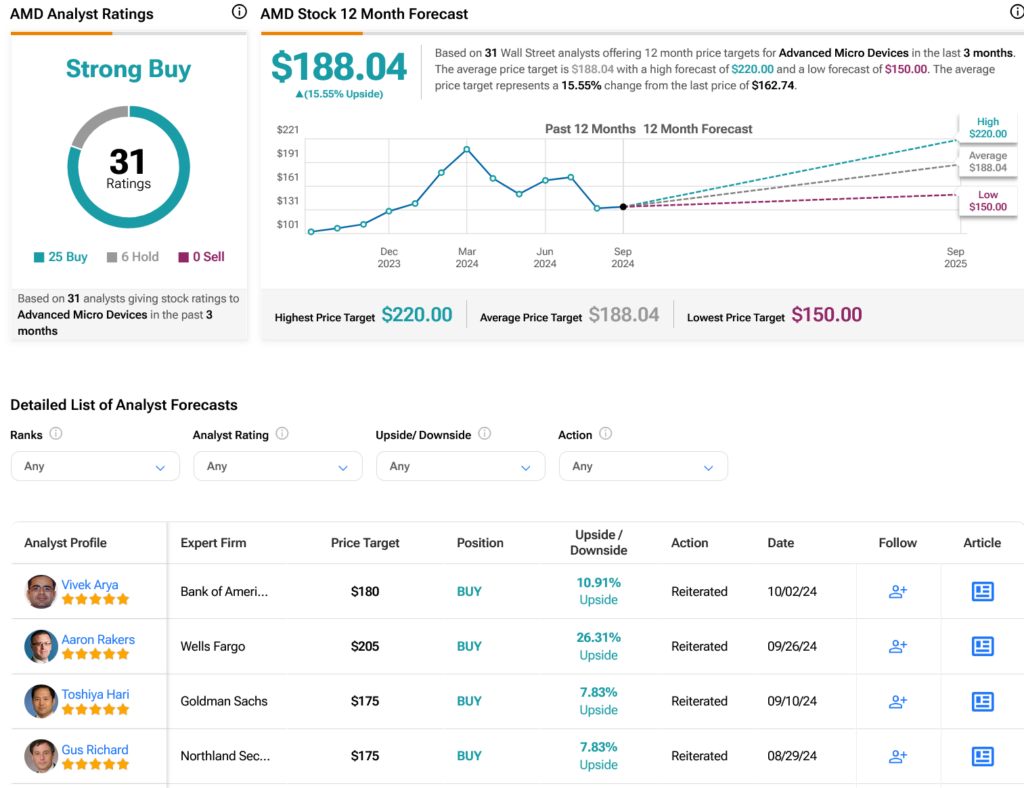

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMD stock based on 25 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 55.95% rally in its share price over the past year, the average AMD price target of $188.04 per share implies 15.55% upside potential.