Insider Berkshire Hathaway (BRK.A) ($BRK.B) sold $766.96 million worth of Bank of America (BAC) shares recently. The Warren Buffett-led conglomerate is surprisingly on a selling spree of BAC stock, which used to be one of his most favored investments. For reference, Bank of America was the second-largest holding in Berkshire’s portfolio as of the end of the June quarter. BRK is a more than 10% owner of BAC.

Higher deposit costs resulted in lower net interest income for BAC in Q2 FY24, while net income fell 5.7% compared to the year-ago period. Buffett’s decision to trim Berkshire’s stake in Bank of America stock could be based on macro concerns.

A corporate insider’s share sale usually signals caution about the company’s future potential. However, an insider might sell shares for other reasons, such as financial or personal obligations.

A Closer Look at the Insider’s Transactions

According to the latest Form 4 filing with the SEC on July 29, Berkshire Hathaway undertook multiple sales of BAC stock between July 25 and July 29. In all, Berkshire sold 18,414,846 shares of BAC at average prices ranging from $41.19 to $42.29 apiece.

It is worth noting that following the latest Informative Sell trade, Berkshire Hathaway still owns 961.65 million BAC shares, worth a massive $40.07 billion. This is the insider’s third major share sale in July alone. His previous trades included Informative Sell transactions worth $802.37 million reported on July 24 and $1.48 billion reported on July 19.

Owing to Buffett’s selling frenzy, Bank of America stock currently has a Negative Insider Confidence Signal on TipRanks. The stock saw $3.0 billion worth of Informative Sell transactions in the last three months.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

What is the Price Target for BAC Stock?

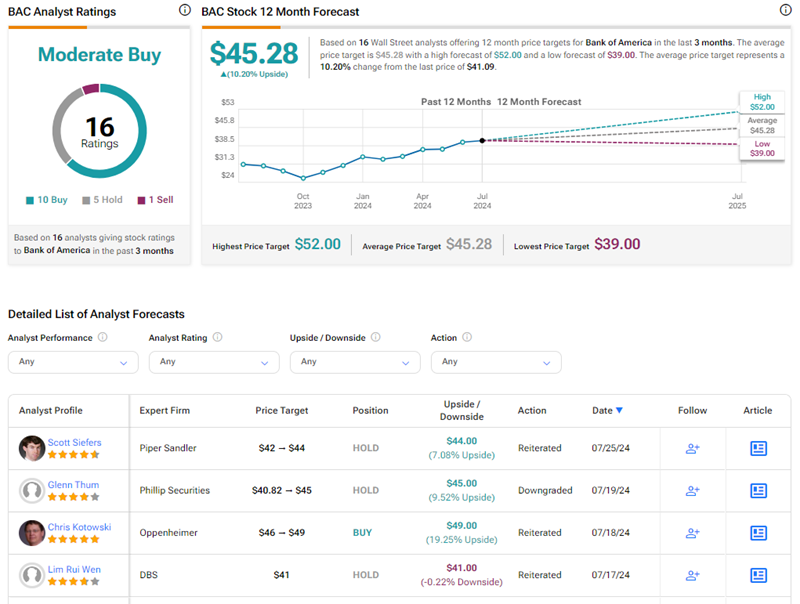

On TipRanks, the average Bank of America price target is $45.28, which implies 10.2% upside potential from current levels. Wall Street remains divided on BAC stock’s trajectory owing to macro uncertainty. Overall, BAC stock has a Moderate Buy consensus rating based on ten Buys, five Holds, and one Sell recommendation.