Bank Hapoalim B.M. (OTHER OTC: BKHYY) has posted impressive results for the first quarter of 2022. The bank’s closing price stood at $46.27 per ADR on Monday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The bank provides corporate and private banking services to customers in Israel. Headquartered in Tel Aviv, the company has a market capitalization of $12.4 billion.

Quarterly Highlights

In the quarter, the bank’s net profit increased 22.2% from the year-ago quarter to NIS 1,654 million. This was driven by an 8.8% rise in fee income and a 6.8% increase in net financing profit as well as a check on costs and expenses.

Net interest income in the quarter was up 21.6% year-over-year to NIS 2,716 million.

The bank’s cash and deposits were NIS 178.3 billion at the end of the first quarter, reflecting a sequential decline of 5.8%. Its net credit to the public was NIS 364.3 billion, up 3.3% quarter-over-quarter. Its liability related to deposits from the public was NIS 519.8 billion, down 1% from the previous quarter.

Talking about metrics, Bank Hapoalim’s return on equity was at 15.6% at the end of the quarter, compared with 13.5% in the year-ago quarter. The bank’s Common Equity Tier 1 capital ratio was at 11.17%.

The NPL ratio was at 0.92% at the end of the first quarter, down 1.11% from the previous quarter.

The bank decided to refrain from distributing dividends so that the amount saved can be used for building long-term growth opportunities.

Plans Ahead

Bank Hapoalim intends to boost its banking activities in corporate, retail, and commercial spaces and work on strengthening its distribution channels, especially on the digital front.

Bloggers’ Stance

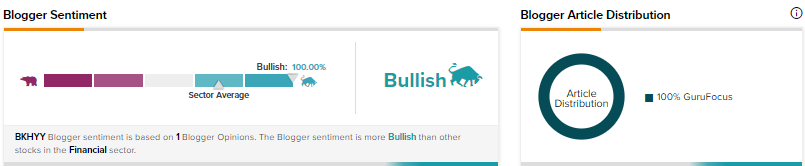

Financial bloggers on TipRanks are 100% Bullish on BKHYY, compared with the sector average of 70%.

Conclusion

Bank Hapoalim is strengthening its footprint in the markets that it serves. Further, it is well-positioned to benefit from a solid capital position, improvements in net profit, and future growth plans.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Nvidia: Why Investors Should Temper Expectations Ahead of Earnings

Heading into Q1, Insiders Make Major Moves at Marvell

Booz Allen Hamilton Posts Q4 Beat & Issues Muted Guidance