The Baltimore bridge collapse that followed a container ship ramming one of its stanchions could have a noticeable impact on supply chains far beyond the Port of Baltimore. The reason is that Baltimore is one of the busiest ports in the U.S., however, it now sits idle as all vessel traffic has been halted. This abrupt halt created instant problems for supply chain managers far beyond the U.S.

The Port of Baltimore is a Critical Waterway

The bridge, along with the bustling Port of Baltimore, constitutes crucial components of the nation’s infrastructure and supply chain, according to the American Trucking Association (ATA). Situated roughly 40 miles from Washington DC, this strategic east coast port has long served as a vital transportation hub.

The collapsed Francis Scott Key Bridge was four lanes wide and 1.6 miles long allowing large trucks an entry point to the Port of Baltimore. The structure now lies on the bottom of the Patapsco River, where it no longer provides a traffic route to Washington, Baltimore, Philadelphia, and New York.

Following the bridge’s collapse, the ATA projected a significant logistical challenge: approximately 4,900 trucks per day, transporting an annual average of $28 billion in goods, must now find alternate routes. This rerouting process entails considerable additional costs, potentially leading to a ripple effect throughout the supply chain and ultimately impacting consumers.

Hardest Hit Industries After Bridge Collapse

With the port now closed, various industries have felt the impact on their supply chains, particularly those that depend on Baltimore for transporting significant equipment such as tractors, combines, forklifts, bulldozers, and heavy-duty trucks bound for the Midwest.

As a result of the closure, shipping costs are expected to rise due to longer routes and potential delays at alternative ports. Consequently, Richard Meade, editor-in-chief of Lloyd’s List, highlighted in a CNBC interview that ocean carriers will seek alternate pathways. The shift of automotive shipments to other Eastern Seaboard ports originally bound for Baltimore will come at a premium.

Furthermore, some automakers, including General Motors (NYSE:GM) and BMW (OTC:BMWYY), have indicated that they do not anticipate the incident to have a significant impact; however, they are working on rerouting vehicle shipments to other ports. Another major player in the area is retail giant Home Depot (NYSE:HD), whose distribution centers remain operational.

Moreover, other companies impacted by the bridge collapse include Consol Energy (NYSE:CEIX), rail company CSX (NASDAQ:CSX), and Ford (NYSE:F).

Baltimore Shipping Bottleneck to Normalize

The supply chain bottlenecks in the Port of Baltimore are expected to gradually return to normal as the alternative routes are established and a new bridge is built. What is unsure is the timeline for a full return to normal. Fortunately for shippers, other ports along the East Coast, such as New York-New Jersey and Norfolk, Virginia, and even down to Florida can absorb spillover from the Port of Baltimore.

Is XTN a Buy, Sell, or Hold?

Following the Baltimore bridge collapse, the SPDR S&P Transportation ETF (XTN) dipped slightly in trading on Tuesday. Over the past five trading sessions, XTN has slid by 0.8% but has performed remarkably well over the past year, gaining by more than 15%.

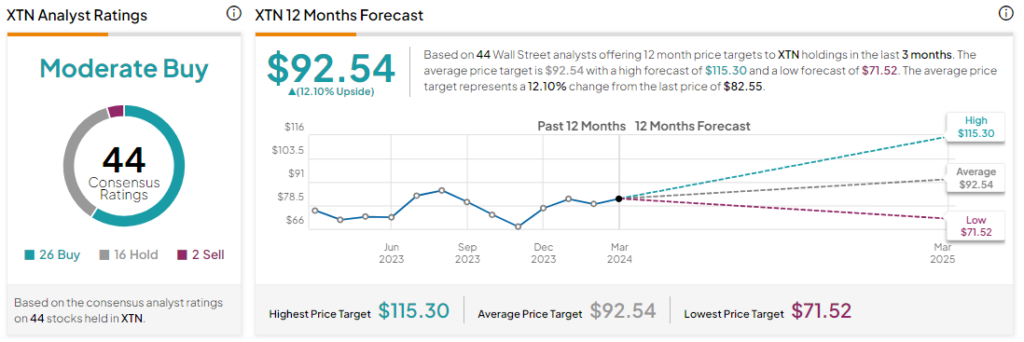

Overall, analysts remain cautiously optimistic about XTN with a Moderate Buy consensus rating based on 26 Buys, 16 Holds, and two Sells. The average XTN price target of $92.54 implies an upside potential of 12.1% at current levels.