It’s the end of another era in Las Vegas, as the Tropicana closed its doors. It had been running for 67 years now and was the third oldest casino operation in Vegas. But now, it’s to be torn down to open space for the Oakland Athletics’ new stadium, and parent company Bally’s (NYSE:BALY), a casino hotel operator, is down over 1.5% in Tuesday afternoon’s trading as investors wonder where it goes from here.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Internal strife is building within Bally’s shareholder pool, as investors are already admonishing chairman Soo Kim to not take an offer to go private. Kim’s private equity fund, Standard General, recently offered $15 per share for Bally’s, which at the time was a substantial premium as it was trading at $10 per share. However, shareholders thought the offer was too low and that both Kim and the market as a whole were undervaluing Bally’s. Why? Because the market seems to have lost confidence in Bally’s overall strategy, which needs to get back to its original focus of gambling.

Shareholder Revolt?

In fact, the shareholders are getting a little rambunctious over the offer, which admittedly does not represent the premium it once did. Currently, it’s within striking distance of $14 a share, which removes a lot of the premium value altogether. In fact, one shareholder put out an open letter declaring the offer “woeful” and calling for a multiple-point plan that includes a sale of its interactive business, a reduction on “vanity” and “negative return” projects, and taking a closer look at the online gaming market.

Some of this is too obvious to bother refuting—who wants “negative return” projects to begin with—but some of it is possibly too aggressive to be reasonable.

Is Bally a Good Stock to Buy?

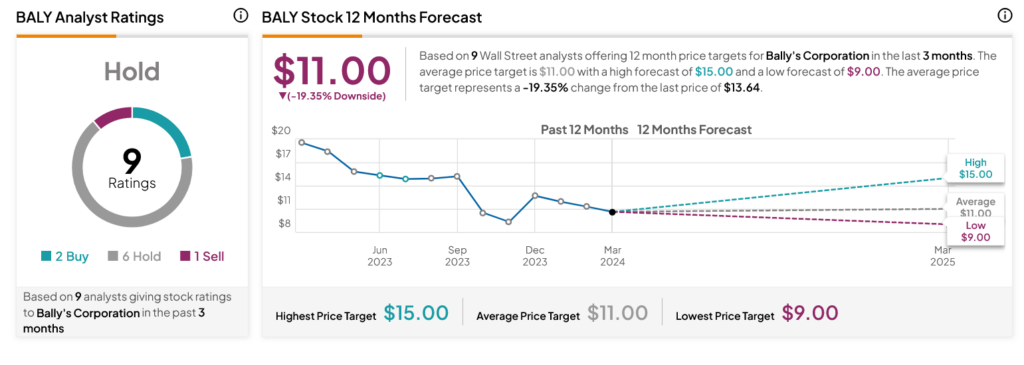

Turning to Wall Street, analysts have a Hold consensus rating on BALY stock based on two Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 24.18% loss in its share price over the past year, the average BALY price target of $11 per share implies 19.35% downside risk.