Ball Corporation (NYSE: BLL) has joined the bandwagon of U.S. companies that have either exited their Russian operations or are planning to do so soon. A few days ago, the company had announced to halt any further investments in Russia.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The ongoing conflict between Ukraine and Russia is taking a toll on the global corporate margins and profitability. Many companies across the globe have chosen to express their resentment against Russia’s actions by shutting down operations there.

Shares of Ball fell 1% to close at $93.28 on Monday.

The company is one of the leading providers of aluminum-based packaging materials. It serves customers in the personal care, household products, and beverages industries. The company is headquartered in Westminster, CO.

What does the Announcement Mean for Ball?

Ball operates three manufacturing facilities in Russia, one each in Argayash, Naro Fominsk, and Vsevolozhsk. It has now decided to lower its activities in the country and eventually exit after finding a suitable buyer for its businesses there.

The accounting for the Russian operation is done under Ball’s Beverage Packaging, EMEA, segment. In addition to Russian operations, this segment accounts for businesses in Europe, Egypt (Cairo), and Turkey (Manisa).

Revenues from this segment totaled $3,509 million in 2021 and accounted for 25% of the company’s total revenues. The segment’s comparable operating earnings for full-year 2021 stood at $452 million.

Notably, revenues derived from the Russian operations accounted for 4% of Ball’s total revenues in 2021, while operating earnings were 8% of the company’s total comparable operating earnings. Also, the company manufactured 5% of the total 112.5 billion beverage cans sipped in 2021 in Russia.

Stock Rating

After considering the possible exit from Russia, Adam Josephson, an analyst at KeyBanc, maintained a Hold rating on Ball.

The Street is cautiously optimistic about Ball’s growth opportunities and has a Moderate Buy consensus rating based on five Buys and eight Holds. Ball’s average price target of $104.50 mirrors 12.03% upside potential from current levels. Over the past year, shares of Ball have increased 10.5%.

Risk Analysis

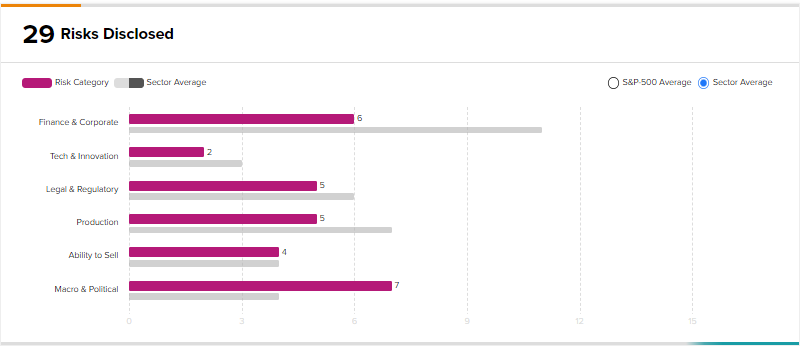

According to the TipRanks Risk Factors tool, Ball stock is at risk mainly from two factors: Macro & Political, and Finance & Corporate. While the Macro & Political category contributes seven risks to the total 29 risks identified for the stock, Finance & Corporate category accounts for six risks.

Conclusion

Lower activities in Russia or exit from the country is likely to have an adverse impact on Ball’s manufacturing capacities, revenues, and operating earnings.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Apple to Slash Production as Global Uncertainties Hurt Demand

GM to Halt Production at Indiana Plant Due to Chip Shortage

Spotify Exits Russia on Fear of New Media Laws