Shares of Booz Allen Hamilton (BAH) surged in pre-market trading after the company announced strong Fiscal second-quarter results. The technology consulting and engineering services firm reported adjusted earnings of $1.81 per share, an increase of 40.3% year-over-year and exceeding analysts’ expectations of $1.48 per share.

Furthermore, the company’s revenue surged by 18% year-over-year to $3.1 billion, above consensus estimates of $2.97 billion.

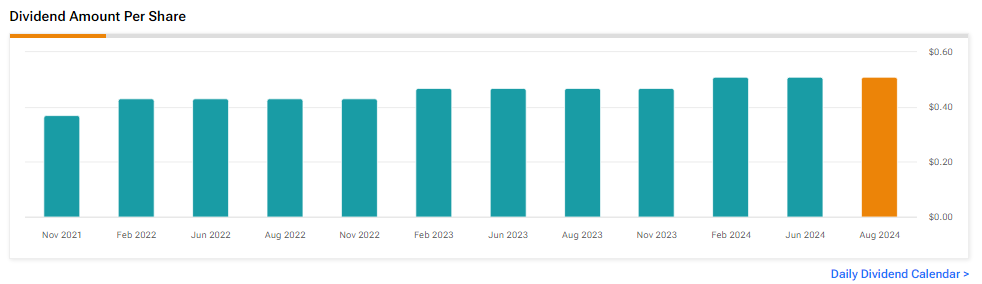

BAH Announces Quarterly Dividend

Additionally, the company announced a quarterly dividend of $0.51 per share, payable on December 4 to stockholders of record as of November 15, 2024.

BAH Raised Its FY24 Outlook

Looking ahead, the company raised its FY24 outlook and expects its revenues to grow in the range of 11% to 13%, compared to its prior forecast between 8% and 11%. Furthermore, adjusted earnings are likely to be in the range of $6.1 to $6.30 per share, compared to its prior estimate between $5.80 and $6.05 per share. For reference, this is above consensus estimates of $5.99 per share.

What Is the Target Price for BAH Stock?

Analysts remain cautiously optimistic about BAH stock, with a Moderate Buy consensus rating based on six Buys, one Hold, and two Sells. Over the past year, BAH has increased by more than 40%, and the average BAH price target of $165 implies a downside potential of 0.9% from current levels. These analyst ratings are likely to change following BAH’s results today.