Shares of financial giant Bank of America (NYSE:BAC) are ticking marginally lower today after the company announced its first-quarter results. Revenue declined by 1.8% year-over-year to $25.82 billion. Still, the figure came in better than expectations by $330 million. Furthermore, EPS of $0.83 outpaced estimates by $0.07.

A Mixed Bag

During the quarter, BAC’s net income declined from $8.2 billion to $6.7 billion compared to a year ago. The company’s net interest income dropped by 3% to $14 billion due to higher deposit costs, which offset gains from higher asset yields and loan growth. Additionally, its provision for credit losses increased to $1.3 billion from $931 million in the year-ago period. BAC’s noninterest expense also rose by 6% to $17.2 billion.

Some Hits and Some Misses for Bank of America

During this period, BAC’s average deposit balances rose by $14 billion to $1.91 trillion. While BAC continued to add new customers in its Consumer Banking vertical, revenue from the unit declined by 5% to $10.2 billion. On the other hand, revenue in its Global Banking, Global Wealth & Investment Management, and Global Markets verticals ticked higher. Notably, its investment banking fees increased by 35% to $1.6 billion.

What Is the Target Price for BAC Stock?

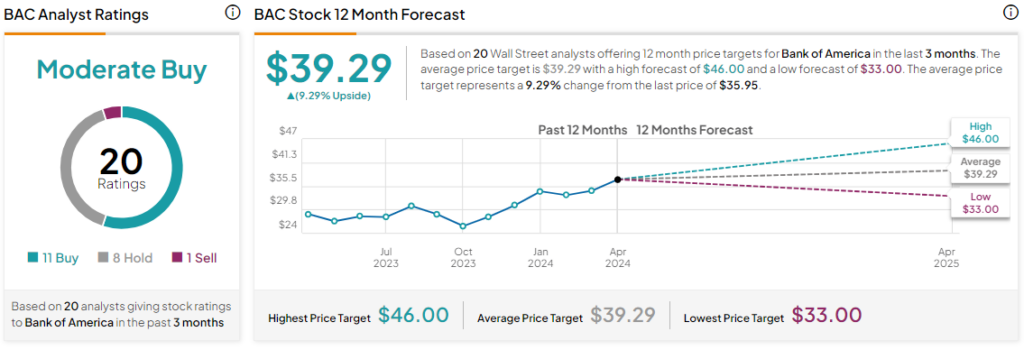

Shares of the company have rallied by nearly 22% over the past year. Overall, the Street has a Moderate Buy consensus rating on Bank of America, alongside an average BAC price target of $39.29. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure