Boeing (BA) reported disappointing results in the second quarter and announced the appointment of a new CEO after months of searching. The aerospace major’s loss widened in the second quarter, with an adjusted loss of $2.90 per share, compared to a loss of $0.82 per share last year. This loss was wider than analysts’ expectations of a loss of $1.90 per share.

Boeing’s Q2 Revenue Breakdown

Moreover, the company’s revenues plunged by 15% year-over-year to $16.8 billion in Q2, below consensus estimates of $17.4 billion. At the end of Q2, Boeing’s order backlog stood at $516 billion. In addition, the company expects its $4.7 billion acquisition of Spirit AeroSystems to close in the middle of next year.

Regarding the company’s Commercial Airplanes business, it reported revenues of $6 billion in the second quarter, a decline of 32% year-over-year. These revenues comprised more than 35% of Boeing’s total revenues in Q2.

In Q2, Boeing delivered 92 commercial airplanes.

Boeing Is Working on Safety Checks

Amidst these financial and operational challenges, Boeing has faced significant reputational and safety issues this year following a high-profile incident involving an Alaska Airlines-operated MAX 9 jet. The aircraft experienced a serious air panel blowout while in mid-air, drawing attention to ongoing safety concerns. In response, Boeing has taken steps to address these issues by submitting a comprehensive safety and quality improvement plan to the Federal Aviation Administration (FAA) during the second quarter.

In addition to addressing these safety concerns, Boeing is also focusing on ramping up its production capabilities. The company plans to increase the production rate of its 737 aircraft to 38 planes per month by the end of this year. This move is part of Boeing’s broader strategy to meet growing demand and strengthen its position in the market.

BA Appoints New CEO

In light of these developments, the company announced the appointment of aerospace industry veteran Kelly Ortberg as its new President and CEO, effective August 8. Ortberg will have the challenging task of turning around the struggling planemaker.

Furthermore, Ortberg’s appointment follows the resignation of CEO Dave Calhoun and the departure of the previous board president. The company’s safety culture came under regulatory scrutiny after a series of accidents involving Boeing’s planes.

Is BA Stock a Good Buy?

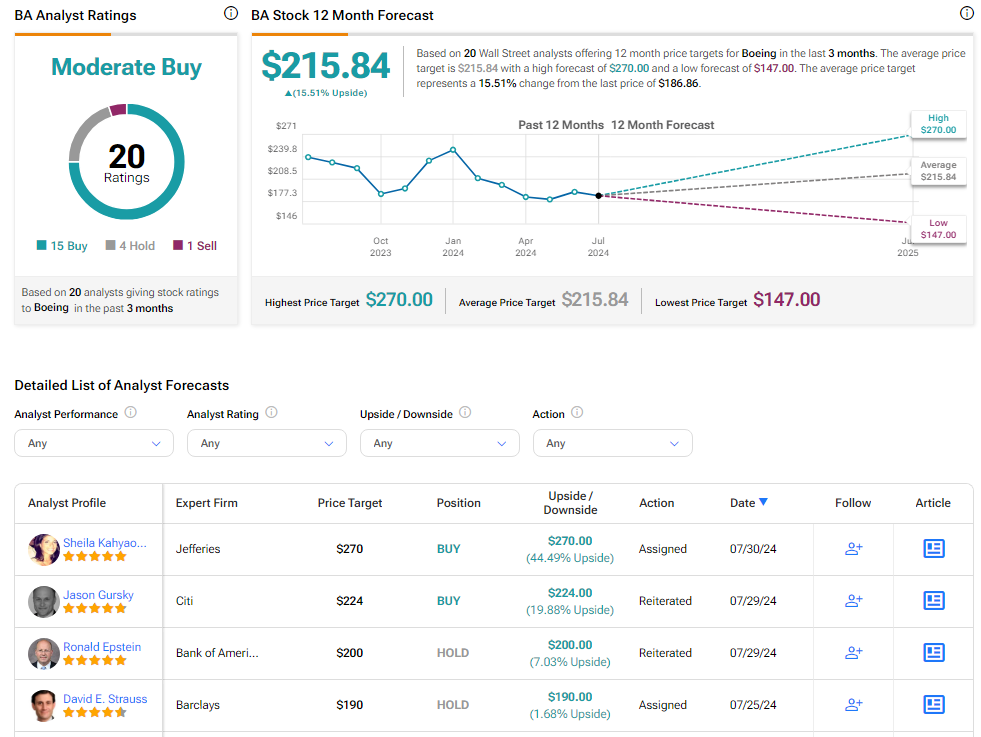

Analysts remain cautiously optimistic about BA stock, with a Moderate Buy consensus rating based on 15 Buys, four Holds, and one Sell. Over the past year, BA has declined by more than 20%, and the average BA price target of $215.84 implies an upside potential of 15.5% from current levels. These analyst ratings are likely to change following BA’s results today.

Questions or Comments about the article? Write to editor@tipranks.com