AutoZone, Inc. (AZO), a major player in the automotive parts industry, has just finished its fourth quarter with solid results. Despite facing some market challenges, AutoZone managed to pull off an impressive $6.2 billion in net sales, marking a 9% increase from the prior year, and aligning with analysts’ consensus estimate of $6.2 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

AZO’s Earnings Per Share (EPS) Hits New High

In terms of earnings, AutoZone reported diluted earnings per share (EPS) of $51.58 for Q4, an impressive 11% increase from $46.41 a year ago, though it fell short of analysts’ consensus estimate of $53.60. This increase reflects not only robust sales but also effective cost management. “We delivered total sales growth of 5.9% for the Fiscal year while earnings per share increased 13.0%,” said Phil Daniele, AutoZone’s President and CEO.

AutoZone’s Share Repurchases Demonstrate Confidence

Speaking of commitment, AutoZone also made headlines with its aggressive share repurchase program. During Q4, the company bought back 244,000 shares at an average price of $2,915, amounting to $710.6 million. For the entire Fiscal year, AutoZone repurchased a staggering 1.1 million shares at an average price of $2,759, totaling around $3.2 billion. This strategy not only signals confidence in the automotive giant’s future but also boosts shareholder value. As Daniele noted, “We will remain committed to our disciplined approach of increasing earnings and cash flow, all while delivering strong shareholder value.”

AutoZone Faces Inventory Challenges

Despite the robust financials, AutoZone faced some challenges, particularly with inventory management. The company’s inventory grew by 6.8% over the past year, a figure attributed to new store openings and growth initiatives. While they are expanding, managing inventory levels efficiently is crucial to avoid excess stock that could tie up capital. Daniele acknowledged the challenges, stating, “While currency rate moves slowed sales and earnings growth, our performance remains strong.”

AZO Looks Ahead with Optimism

AutoZone isn’t resting on its laurels. The company opened 68 new stores in the U.S., 31 in Mexico, and 18 in Brazil during the quarter, bringing its total store count to 7,353. As they continue to expand both domestically and internationally, AutoZone seems poised to capture even more market share in the automotive parts sector.

Is AZO Stock a Buy, Sell or Hold?

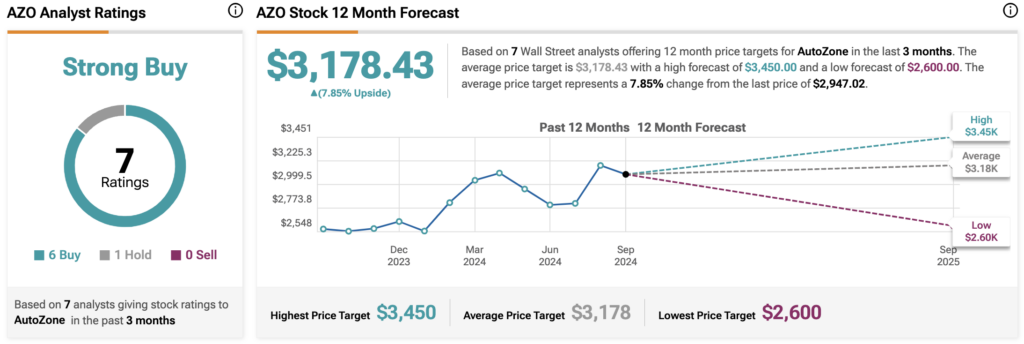

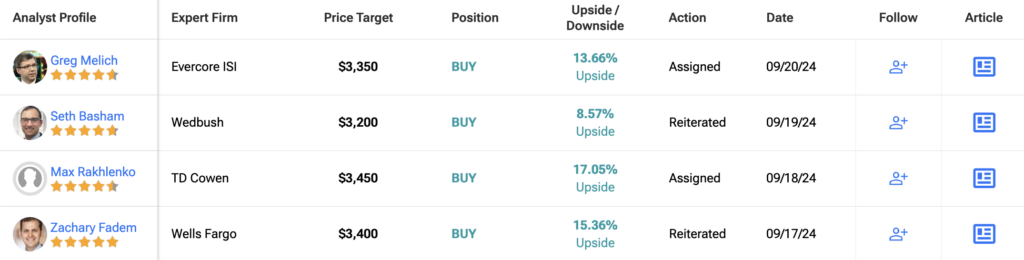

Analysts remain bullish about AZO stock, with a Strong Buy consensus rating based on six Buys and one Hold. Over the past year, AZO has surged by over 15%, and the average AZO price target of $3,178.43 implies an upside potential of 7.9% from current levels.