Many will say that tensions have never been higher on the streets in the U.S., with political division, rising crime rates, and budgets under pressure across government departments. Not many companies will view this landscape as an opportunity, but I think Axon (AXON), which provides public safety technology, could be uniquely positioned to do very well over the coming years. I’ve long been a fan of the company, and with shares up 167% in the last year alone, there are clearly reasons to be positive, but I think there’s plenty more to come.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Axon Is Excelling in a Challenging Space

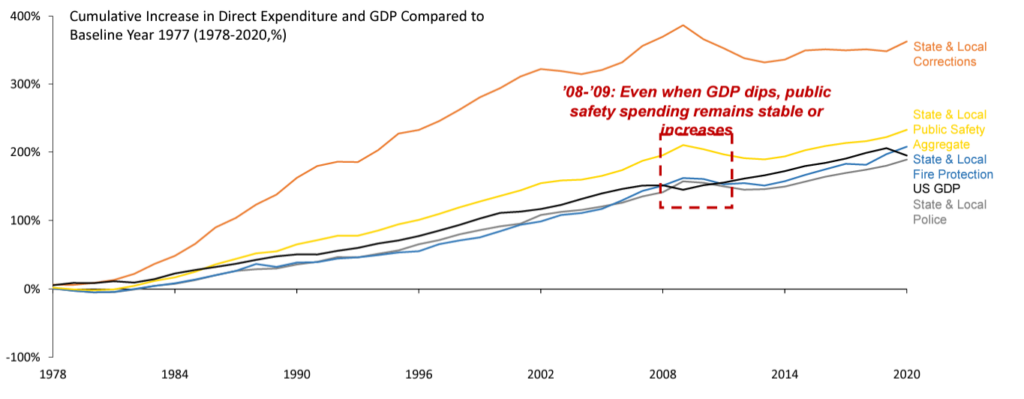

I feel like now is a pretty bullish moment for all companies in the space. Public scrutiny of the police services has probably never been higher. With the growing presence of social media and immediate virality when things go wrong, public safety departments are making big investments in the technology and systems needed to protect the public, and personnel responsible for security.

This trend is obviously hugely encouraging for Axon, given the company’s mission to “protect life, capture truth and accelerate justice,” closely aligning with the urgent need to build advanced systems to quickly neutralize threats in a cost-effective way. By building a highly effective set of technologies across 17,000 partners in law enforcement, corrections, and private security markets, the company is cementing a reputation that could lead to sector dominance in the coming decades.

Management already sees a total addressable market (TAM) of $77 billion across these areas, and I think this will only increase as companies review security threats.

Axon’s Flagship Products Driving Adoption

Many investors will be aware of Axon’s less-lethal TASER product, which has become the gold standard for law enforcement looking to reduce the frequency and severity of gun-related incidents. This has been highly successful in de-escalation measures, but is really just one product in the suite of those offered by Axon.

Further, the Axon cloud suite is becoming increasingly critical for emergency services, providing best-in-class digital evidence management systems, including body cameras, in-car systems, and other products to create a meaningful archive of evidence from dynamic situations. AI-powered solutions are also working on the back of these systems, with the company’s Draft One helping to automate report writing. This significantly reduces paperwork, allowing teams to spend more time in the field, and leading to impressive savings and efficiencies for all involved.

As is the case for most companies at present, building such an archive of meaningful data can lead to enormous insights. By hosting all information in a secure, centralized platform, machine learning systems can lead to further automation and innovation, setting the company apart from the competition.

Axon’s Strong Fundamentals

To me, Axon’s latest earnings report backs up the impressive nature of the services and products on offer. With Q3 2024 revenue soaring 32% year-over-year to $544 million, management seems pretty bullish on the performance of the business. Customers are also showing some serious loyalty to the company, with 123% net revenue retention demonstrating that once one product is implemented, they tend to want the full suite.

Also, I like what I see in the balance sheet of the company, with healthy cash reserves of $1.2 billion providing plenty of flexibility for new initiatives and riding out any near-term challenges. Debt levels also don’t seem to be a major concern, with about $720 million of liabilities.

Addressing Valuation Challenges and Risks

I’m very bullish on Axon Enterprise, but recognize there are indeed challenges to address. Of course, after such a rally over the last year, many will suggest that this growth is already baked into the share price, with all the efficiencies already reflected. Admittedly, the share price is at a fairly premium valuation already, with a forward P/E ratio (Non-GAAP) of 122x compared to the sector median of 21.2x. However, I think if management can continue to meet expectations and drive user growth, there’s still a healthy amount of potential here for investors.

Clearly, we are in uncertain times with regard to government spending, with an incoming Trump administration suggesting some major shake-ups to some of the biggest departments. From the rhetoric, I see efficiencies and cutbacks being key over the coming years. As I noted, many companies will be concerned by this, but with the reductions in bureaucracy and risk offered by Axon through its AI systems and drones, I see it as a big winner regardless of any reforms.

With gross margins expanding and operating cash flow up 45% over the last year, the company is clearly doing all it needs to do to keep growing while offering major efficiencies to customers clearly needing it.

Is AXON Stock a Buy, According to Analysts?

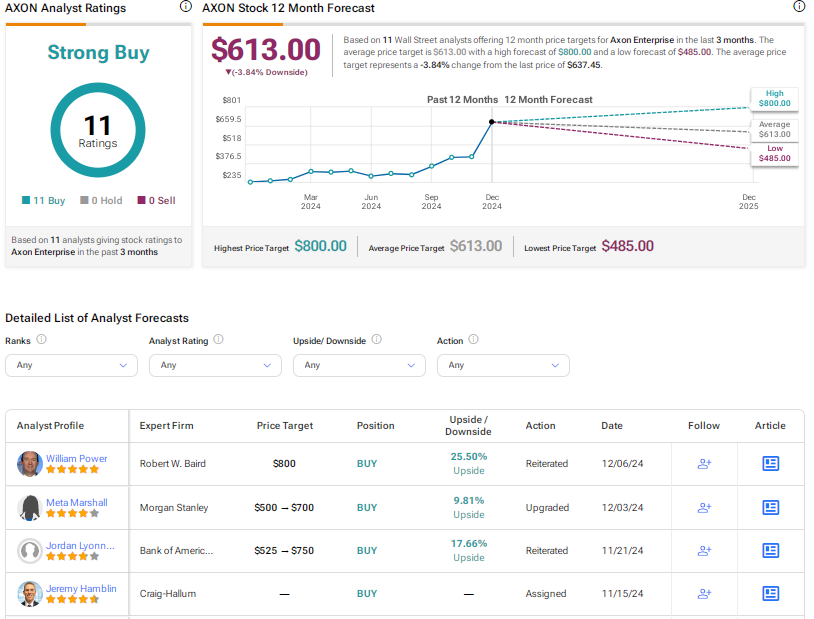

Wall Street has a Strong Buy consensus rating on Axon Enterprise stock based on 11 unanimous Buys. However, given the rally in the stock, the average AXON stock price target of $613 indicates a downside risk of about 4%. Some analysts see plenty of further upside, making reference to the potential of the sector both domestically and internationally.

Identifying Catalysts for Further Growth

As I noted, there are plenty of reasons for investors to believe there is plenty more to come for the company’s growth story. In fact, I think it’s potentially just getting started.

As we all know, AI is transforming so many of the companies on the market. But rarely is the application so clearly beneficial than in the emergency services sector. Solutions involving drone technology as first responders offer tremendous cost-savings and safety benefits, arriving before officers can, and providing a real-time situational report to multiple departments and services.

I see plenty of opportunities for the company to expand its capabilities too. Recent acquisitions of Fusus and Dedrone show that management is keen about Axon becoming a market leader in some really exciting areas, with applications for video analytics and drone technology far beyond the security sector. It’s worth noting that the firm is really just beginning its journey beyond the U.S., with enormous opportunities in international markets.

Summing Up

For me, Axon Enterprise is far more than just another security company. It’s becoming a transformation engine for the entire public safety element of government. By driving AI innovation and moving into international markets, there are enormous opportunities for the company to build market share as uncertainty and tensions remain high.

Of course, the right strategy will need to be adopted to manage the risks inherent to the sector, but I have confidence that management has all the tools and experience needed to see success in the coming years, both for the company and for Axon investors.