Chip stocks rallied on Monday, led by Broadcom (AVGO) and Advanced Micro Devices (AMD), after analysts highlighted the growing opportunities tied to artificial intelligence (AI). Broadcom surged 5.5% after UBS, led by five-star analyst Timothy Arcuri, boosted its AI revenue forecasts for 2026 and 2027 by 20% and 40%, respectively, while also maintaining a Buy rating and raising its price target to $270. For reference, this is a 16% premium over Monday’s close of $232.35.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

On the other hand, AMD saw significant gains of 4.5% to $124.60 after Rosenblatt, which is led by another five-star analyst, Hans Mosesmann, named it a “top pick” for early 2025. The analyst pointed to AMD’s growing market share and its AI potential, as well as its expected recovery in non-AI markets later in the year. While Rosenblatt reiterated a $250 price target, well above the Wall Street average, AMD shares are still down 15% year-to-date despite Monday’s momentum.

It is worth noting that both Timothy Arcuri and Hans Mosesmann have solid track records with success rates of 71% and 69%, respectively. In addition, their average returns per rating stand at above 30% each.

Which Chip Stock Is the Better Buy?

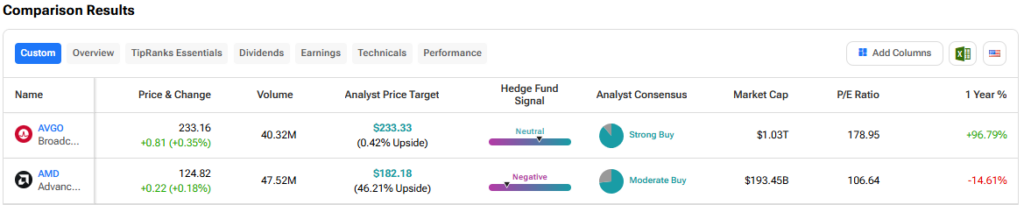

Overall, out of the two stocks mentioned above, analysts think that AMD stock has more room to run than HPE. In fact, AMD’s price target of $182.18 per share implies over 46% upside potential versus AVGO’s 0.42%.

Interestingly, though, hedge funds seem to be more confident in AVGO with a neutral signal compared to AMD, which has a Negative signal. In fact, 520,600 AVGO shares were purchased in the previous quarter by the fund managers tracked by TipRanks while 744,700 AMD shares were sold.

It will be interesting to see if the managers that dumped AMD shares will make a return and push it share prices higher in 2025. It is also worth noting that investor Cathie Wood from ARK Investment Management LLC was a huge AMD buyer despite the net selling. Indeed, her firm increased its stake in AMD by 231.64% to $128,854,157 during the quarter.