AutoZone stock (NYSE:AZO) has experienced a modest correction recently, with investors likely worried about a deceleration in the company’s domestic sales. However, this appears to be due to one-off factors, including softer tax refunds and less favorable weather conditions. Apart from these elements, the after-market auto parts retailer’s performance remains robust. International sales continued to increase rapidly while margins were on the rise. Thus, I am bullish on the stock and will gradually increase my position.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Breaking Down AutoZone’s Fiscal Q3 Sales

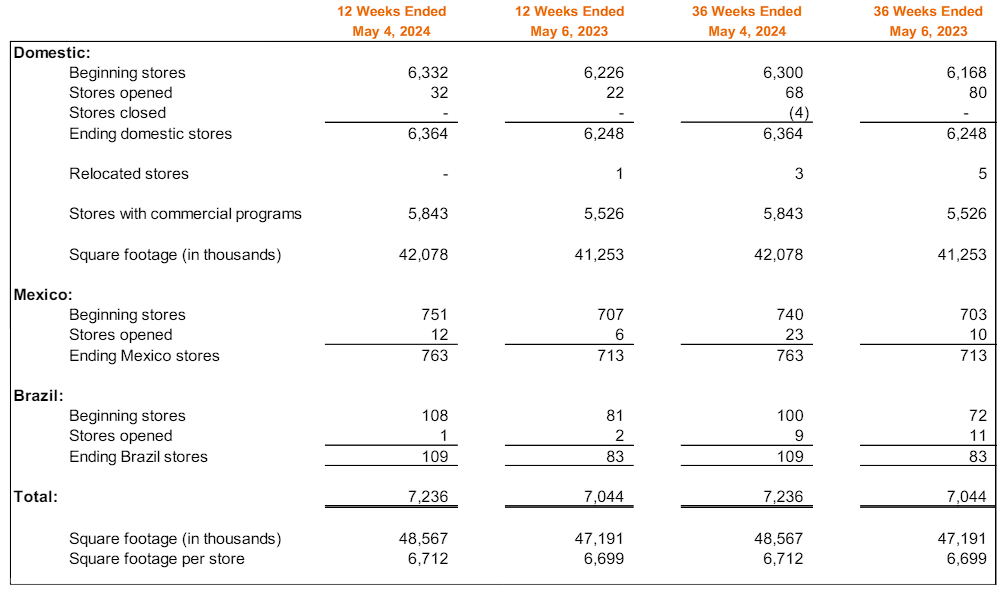

AutoZone’s Fiscal Q3 sales seem somewhat mixed at first glance. The company continued executing its proven strategy, maximizing same-store sales and growing its store count. In fact, its comparable sales rose by 1.9%, and new net openings totaled 45 during the quarter. Along with the stores opened in the previous four quarters, AutoZone ended Fiscal Q3 with 7,236 locations, up from 7,044 in the prior year period (see below). The increase in store count and same-store sales resulted in total revenue growth of 3.5% to $4.2 billion.

As we dive a little deeper, you can see that the 1.9% increase in same-store sales is due to flat domestic revenues and an 18.1% increase in international revenues (or a 9.3% increase in constant currency). The lack of domestic growth may initially seem quite concerning. Nevertheless, this was due to one-off headwinds that shouldn’t affect AutoZone’s results over the long term.

Specifically, the company posted flat same-store sales in domestic stores due to two factors. First, tax refund flows were softer than expected in February, negatively affecting the first three weeks of Fiscal Q3’s domestic same-store sales. According to management, tax refunds play a notable role in people’s ability to afford car repairs, which explains the sales lag.

The second factor was weather-related conditions. Unfortunately for AutoZone, the weather was cooler and wetter than expected, especially in the Northeast and Midwest markets. This translated to fewer car breakdowns and/or less weather-related damages. Consequently, sales in these markets were noticeably softer than under normal weather conditions.

However, both tax refunds and weather-related effects don’t impact AutoZone’s long-term bull case, which is supported by the rising average age among registered vehicles and robust internal combustion engine (ICE) after-market parts pricing power.

Margins on the Rise, Strong EPS Growth

Moving to the bottom line, AutoZone’s results were significantly stronger. While sales were respectable, given the circumstances, the highlight was profitability. AutoZone’s gross and operating EBIT margins reached 53.5% and 21.3%, respectively, marking an expansion of 102 and 27 basis points. However, a higher tax rate of 18.1% compared to last year’s 17.4% posed a challenge to net income, which grew by just 0.6%.

Operationally, though, AutoZone continues to make progress. The higher tax rate was attributed to fewer stock options exercised compared to the previous year, suggesting this impact is temporary. Conversely, the margin expansion is likely to persist.

Despite the modest net income growth, AutoZone’s earnings per share (EPS) increased by a notable 7.5%, mainly driven by its huge share buybacks. Known as the “King of Buybacks,” the pace at which AutoZone repurchases and retires shares is hard not to be impressed with.

The Valuation Is Reasonable

Over the past three years, investors have paid between 15x and 20x for AutoZone’s forward earnings, with the multiple fluctuating multiple times within this range during this period. Today, the stock is hovering at a forward P/E of 17.5x, precisely at its three-year average. I believe this is a reasonable valuation for AutoZone.

With Wall Street expecting EPS growth of 14.8% per annum through 2029, the stock continues to offer a good chance of double-digit returns over the medium term, even if its valuation multiple gets compressed further.

Is AZO Stock a Buy, According to Analysts?

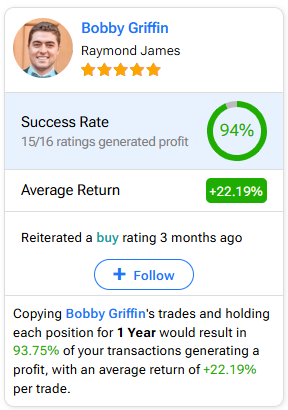

Regarding Wall Street’s opinion on AutoZone, the stock has a Strong Buy consensus rating based on 15 Buys and three Holds assigned in the past three months. At $3,197, the average AZO stock price prediction suggests 15.2% upside potential over the next 12 months.

If you’re unsure which analyst you should follow if you want to buy and sell AZO stock, the most accurate analyst covering the stock (on a one-year timeframe) is Bobby Griffin of Raymond James, with an average return of 22.19% per rating and a 94% success rate. Click on the image below to learn more.

The Takeaway

AutoZone’s overall performance remains solid despite unexpected events such as softer tax refunds and unfavorable weather conditions affecting domestic sales. With international sales growing rapidly, margins expanding, and the average U.S. vehicle age on the rise, AutoZone’s long-term prospects appear strong.

Further, the stock’s valuation is reasonable against Wall Street’s medium-term EPS growth estimates, further supporting a bullish outlook. For this reason, I remain confident in AutoZone’s potential and will continue to grow my position in the stock opportunistically.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue