AutoNation (AN), an auto retailer, recently announced impressive second-quarter 2021 on the back of solid demand for its vehicles.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Notably, quarterly adjusted earnings surged 243% year-over-year to $4.83 per share, comfortably beating the Street’s estimates of $2.58. (See AutoNation stock chart on TipRanks)

Quarterly revenues of $6.98 billion were up 54% year-on-year, surpassing analysts’ expectations of $6.02 billion.

Mike Jackson, AutoNation’s Chief Executive Officer, said, “Demand continues to outpace supply for new vehicles. We expect this to continue into 2022 due to consumers’ preference for personal transportation coupled with lower interest rates.”

Revenues from new vehicles increased 51.6% year-over-year to reach $3.43 billion, and that from used vehicles rose 65.2% year-over-year.

Gross profit of $1.3 billion was a rise of 66.8% compared to the year-ago period.

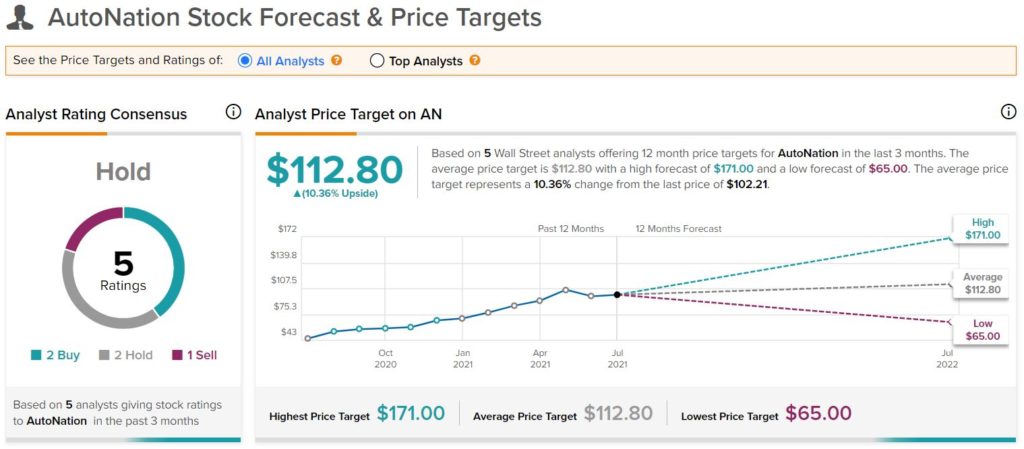

On July 16, Bank of America analyst John Murphy reiterated a Buy rating on AutoNation. However, he raised his price target to $171 from $161 on the stock, implying a 66.7% upside potential to current levels.

Murphy had backed his rating by saying that he expects the company to beat estimates in its second quarter earnings release, despite weak outlook for the automotive industry. He believes that the current shortage in the chip market might be hurting the top line, but an expected demand surge will be “more rationally released over a multi-year recovery”.

Consensus among analysts is a Hold based on 2 Buys, 2 Holds and 1 Sell. The average AutoNation price target of $112.80 implies 9.9% upside potential to current levels.

Recent News:

T Mobile Completes First Successful RCD-Integrated Wireless Call

Telefonica Hands Spanish 5G Frequency Bands to Nokia and Ericsson

Zoom to Acquire Five9 for $14.7B