Shares of ASX-listed Life360, Inc. (AU:360) soared to record high levels today following the release of strong Q2 2024 results. The company’s free member base increased by 4.3 million MAUs (monthly active users) in Q2 and surpassed the 70 million mark. Following the announcement, Life360 shares gained 18.09% in today’s session. Year-to-date, the stock has rallied by around 135%, driven by strong operational performance and an upbeat outlook.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Life360 is a U.S.-based technology company providing location-based services to users worldwide. Its main product is the Life360 family social networking app, which was introduced in 2008.

Life360’s Q2 Results Highlights

In the second quarter, Life 360’s total revenue grew by 20% year-over-year to $84.9 million. Meanwhile, its core subscription revenue increased by 25% to $60.2 million as compared to the same period last year.

Additionally, the company reported a positive adjusted EBITDA of $11 million compared to $5.7 million in the prior-year quarter. However, the Q2 EBITDA loss increased to $5.6 million from $2 million a year ago due to IPO transaction costs of $5.8 million.

Life360 launched its IPO (initial public offering) in the U.S. and began trading on the NASDAQ Global Select Market on June 6, 2024.

Life360 Raises Guidance

Driven by solid performance, Life360 raised its full-year guidance for revenue and EBITDA (earnings before interest, tax, depreciation, and amortisation). The company now expects its consolidated revenue to range between $370 million and $378 million, an increase from $365 million and $370 million.

Similarly, its core subscription revenue is projected to grow over 25% year-over-year, up from the earlier forecast of more than 20%.

Looking ahead, Life 360 sees significant potential in global markets. It plans to expand into new regions and roll out new features. The company expects a significant rise in ad revenue in the second half of the year. Life360 launched a new advertising offering earlier this year in the U.S., with plans for a global rollout soon.

Is Life360 a Good Stock to Buy?

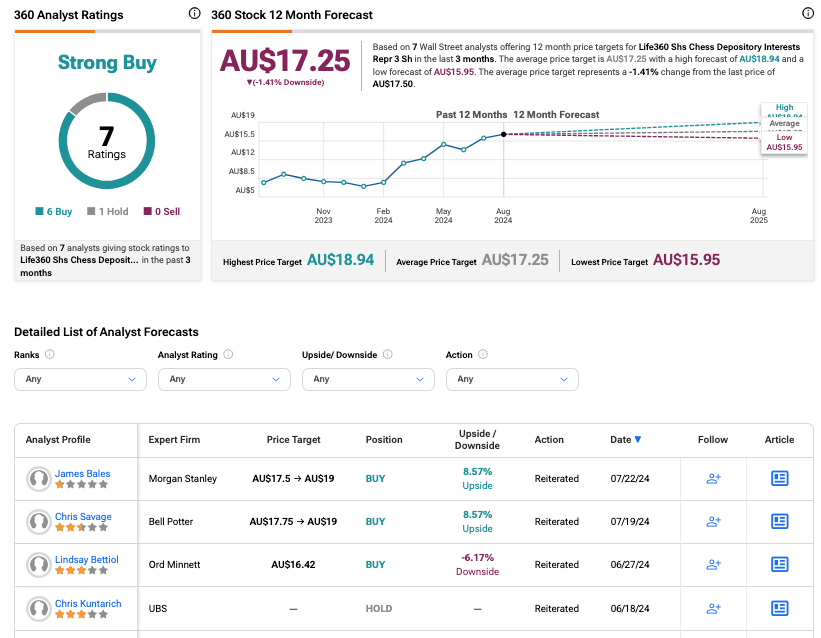

According to TipRanks’ rating consensus, 360 stock has received a Strong Buy rating based on six Buys and one Hold recommendation from analysts. The Life360 share price target is AU$17.25, which is 1.41% below the current price level.