Aurinia Pharmaceuticals has inked a collaboration and license agreement with Japan’s Otsuka Pharmaceutical Co. for the development and sale of oral voclosporin for the treatment of Lupus Nephritis (LN) outside the US.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Specifically, Aurinia (AUPH) and partner Otsuka will develop and commercialize oral voclosporin across the European Union (EU), Japan, as well as the UK, Russia, Switzerland, Norway, Belarus, Iceland, Liechtenstein and the Ukraine. As part of the agreement, Aurinia will get an upfront cash payment of $50 million with the potential of receiving up to an additional $50 million in regulatory and reimbursement milestone payments.

Additionally, Aurinia will be eligible to get tiered royalties ranging from 10% to 20% on net sales, as well as other milestone payments based on the attainment of annual sales by Otsuka.

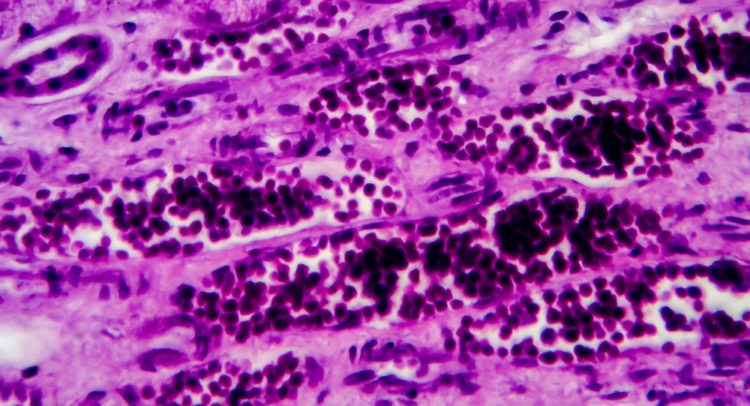

Voclosporin is an investigational, orally administered treatment to treat patients with LN, which is a life-threatening chronic inflammation of the kidneys in patients with lupus, a disorder in which the body’s immune system attacks itself.

“Otsuka, with strong capabilities in nephrology and rare disease, is an ideal strategic partner to introduce voclosporin in Europe and Japan,” said Aurinia CEO Peter Greenleaf. “This collaboration will provide Aurinia with additional non-dilutive funds to focus on the successful US launch of voclosporin and support plans to build our pipeline, while ensuring more lupus nephritis patients around the world can benefit from this potentially life-saving medication.”

Otsuka, which expects to file a marketing authorization application (MAA) with the European Medicines Agency (EMA) in the second quarter of 2021, will also manage the filing of voclosporin for LN with the Pharmaceuticals Medical Devices Agency (PDMA) in Japan at a later date, the companies said in a statement.

Voclosporin is currently under review by the US Food and Drug Administration (FDA) with an assigned Prescription Drug User Fee Act (PDUFA) target action date set for January 22.

On a year-to-date basis, the stock is now trading down 36% yet the Street has a bullish Strong Buy analyst consensus on Aurinia. That’s with 6 recent Buy ratings. The average analyst price target of $23.77 indicates upside potential of over 82% lies ahead.

In response to the collaboration news, Oppenheimer analyst Justin Kim remains enthusiastic and reiterated a Buy rating on the stock with a $20 price target (53% upside potential) citing the potential for voclosporin to generate blockbuster sales in the long-term.

“While investors have scrutinized the deal’s $50 million upfront payment myopicly, securement of a global ex-US partner for renal diseases, particularly for this indication, we believe is an achievement,” Kim commented in a note to investors. “Given the complexity of ex-US commercialization, greater price sensitivity for immunological therapies, we have viewed the US opportunity as ~70–80% of the global opportunity for voclosporin.”

“As Aurinia positions itself for a potential approval next month and continues to check the boxes for a strong commercial launch, we stay bullish,” the analyst summed up. (See AUPH stock analysis on TipRanks).

Related News:

Moderna’s Covid-19 Vaccine Wins FDA Emergency Use Approval

Mesoblast Fails to Meet Primary Endpoint in COVID-19 Trial; Street Sees 29% Upside

FedEx Shares Fall 4% Despite 2Q Earnings Beat; Analysts Stay Bullish