Shares of aTyr Pharma jumped 5.7% in Tuesday’s extended trading session after the biotherapeutics company posted a smaller-than-expected loss in the fourth quarter. Furthermore, revenues topped analysts’ expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

aTyr (LIFE) incurred a loss of $0.47 per share in 4Q, compared to the $0.82 loss per share estimated by analysts. Results did however compare favorably to the prior-year quarter’s loss of $1.54 per share.

The company generated total revenues of $2.1 million in the quarter, above analysts’ expectations of $130,000.

Research and development expenses were $4.7 million in the quarter, up 30.6% year-over-year. Total general and administrative expenses declined 8% to $2.3 million. (See aTyr stock analysis on TipRanks)

aTyr CEO Sanjay S. Shukla said, “We are highly encouraged by our progress and look forward to building upon our programs and novel tRNA synthetase biology platform as we move forward this year.”

“Most notably, we have advanced and expanded our clinical program for ATYR1923. We completed enrollment in our Phase 1b/2a trial for our lead interstitial lung disease (ILD) indication, pulmonary sarcoidosis, and data from this proof-of-concept study is expected in the third quarter of this year,” Shukla added.

On March 16, Roth Capital analyst Zegbeh Jallah increased the stock’s price target to $20 (306.5% upside potential) from $15 and reiterated a Buy rating.

Jallah’s action followed the company’s positive biomarker data from the Phase 2 PoC study of its lead drug, ATYR1923, in moderate-to-severe COVID-19 patients.

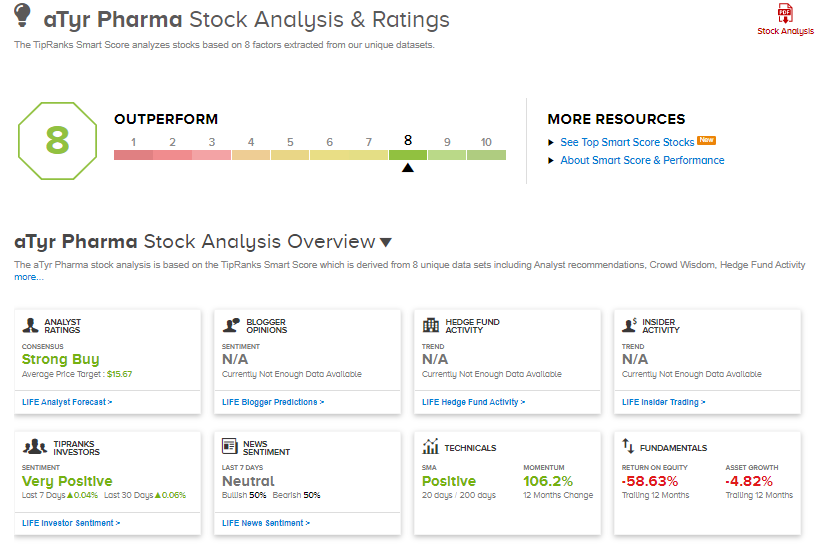

aTyr shares have rallied 77% over the past year, while the stock still scores a Strong Buy consensus rating based on 3 unanimous Buys. That’s alongside an average analyst price target of $15.67, which implies 218.5% upside potential to current levels.

What’s more, aTyr scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Ametek Inks Deal To Acquire Abaco Systems For $1.35B

Embraer Posts Smaller-Than-Feared Quarterly Loss; Shares Pop 7%

FDA Accepts New Drug Application For Bristol Myers Squibb’s Mavacamten