AT&T and the University of Connecticut have signed a strategic partnership deal to enhance entrepreneurship and innovation using 5G. Under the terms of the partnership, the wireless career is to provide high-speed wireless connectivity at UConn Stamford.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

AT&T’s (T) high-speed 5G network should allow the university to advance its academic programs and expand entrepreneurial activity. The high-speed internet service should help accelerate the UConn Stamford Data Science initiative while enhancing connections between industry experts and the University students and faculty.

AT&T’s 5G+ mmWave should enhance UConn’s ability to serve the state and region by improving its innovation ecosystem. In addition to the social and economic impact, the 5G connections should help enhance student life.

AT&T shares are up 4.31% this year after a 26% slide in 2020. (See AT&T stock analysis on TipRanks).

According to AT&T Business CEO Anne Chow, 5G connection should open new business models, products, services, and solutions. Its widespread adoption should also transform the business world and bring exponential benefits.

“Leading universities like UConn Stamford are utilizing 5G to empower students and faculty to innovate and make learning come alive in the most extraordinary ways. There’s no better place for 5G to be explored than on college campuses with our next generation of leaders,” said Chow.

The UConn partnership comes with AT&T committing $2 billion in broadband investment over the next three years. The investment will bolster community broadband infrastructure development in conjunction with FCC’s Emergency Broadband Benefit program.

According to Raymond James’s analyst Frank G Louthan, the impact of the EBBP is yet to be fully felt. The analyst has an outperform rating on AT&T with a share price target of $32, implying 10% upside potential to current levels.

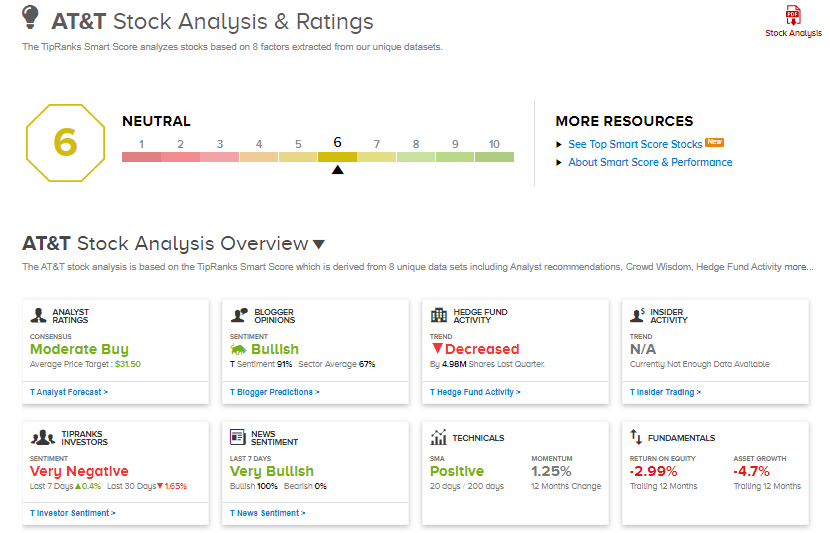

AT&T is currently rated as a Strong Buy on Wall Street based on 5 Buys, 6 Holds, and 1 Sell. The average analyst price target of $31.50 implies 5% upside potential to current levels.

AT&T scores 6 out of 10 on the TipRanks’ Smart Score tool, implying its performance is expected to align with market averages.

Related News

Amazon Becomes Europe’s Largest Corporate Renewable Energy Buyer, Announces Nine New Projects

Nio And Sinopec Sign Pact To Enhance China’s Smart EV Industry

IBM Acquires myInvenio To Enhance Business Processes Automation