AT&T (T) has launched a cybersecurity product built specifically to meet the security needs of government agencies, from the federal to the local level. The cost-effective solution is called AT&T Threat Detection and Response for Government.

AT&T primarily offers telecom services and operates one of the largest wireless networks in the U.S. On top of that, it offers an array of services, including protection against digital threats.

The new cybersecurity solution for the government is Fed-approved and will help public sector agencies reduce their cybersecurity risks. The company notes that public sector agencies at all levels handle sensitive data and support critical infrastructure, yet face persistent digital threats.

“The need for effective threat detection and response is more important than ever as federal and state agencies and departments look to modernize legacy systems and embrace cloud computing,” said AT&T’s Brandon Pearce, Assistant Vice President of Product Marketing Management.

The AT&T Threat Detection and Response for Government is based on the company’s Unified Security Management (USM) platform. The platform integrates threat detection, incident response, and compliance management.

Although AT&T’s product is built on Amazon’s cloud, it can be used in Microsoft and Google cloud environments as well. (See AT&T stock analysis on TipRanks)

Wells Fargo analyst Eric Luebchow maintained a Sell rating with a price target of $25 on AT&T stock. Luebchow’s price target suggests 13.67% downside potential.

Earlier this week, AT&T announced WarnerMedia’s merge with Discovery. Commenting on the deal, Luebchow states, “This transaction would enable T to focus more attention into its core telco segments (wireless and fiber-to-the-home), despite taking away the business segment with the highest growth potential (HBO Max).”

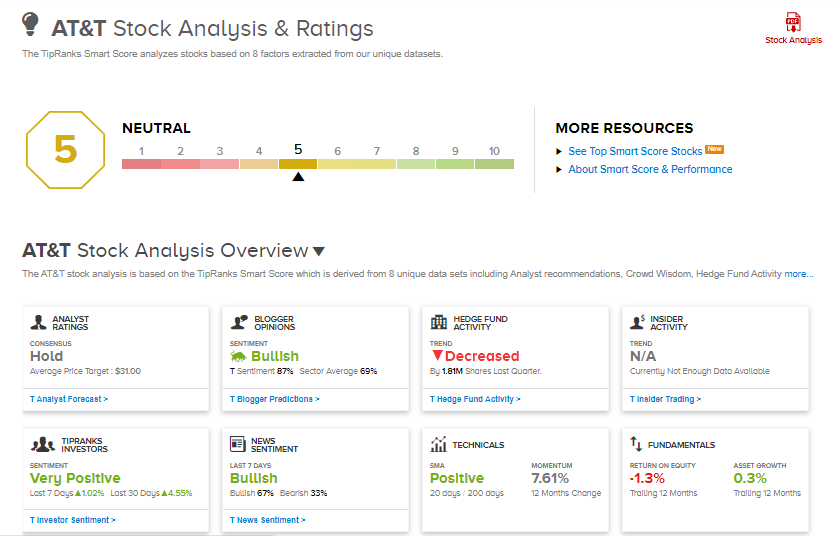

Consensus among analysts on Wall Street is a Hold based on 5 Buy, 7 Hold, and 2 Sell ratings. The average analyst price target of $31 implies 7.04% upside potential to the current price.

AT&T scores a 5 out of 10 on TipRanks’ Smart Score rating system, indicating the stock’s returns are likely to align with market performance.

Related News:

IBM Acquires Waeg to Bolster Its Salesforce Business in Europe

Home Depot Delivers Strong Q1 Results, Net Earnings Nearly Double

Baidu Reports Strong Q1 Results, Issues Upbeat Q2 Guidance