Shares in Atlassian (TEAM) popped 9% in Friday’s trading after the company announced significant changes to its cloud, server, and data center products.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Notably, TEAM will end new server license sales (from February 2021) and will also end support to all server products (starting February 2, 2024).

It will also increase server maintenance prices and increase prices for Data Center (effective February 2, 2021, mostly for new subscriptions vs. changes to existing subscriptions). Also on the pricing front, TEAM will update its cloud pricing (as of October 6, 2020; impact varies by product, user level, existing vs. new license).

To ensure a smoother and faster transition, Atlassian will also offer three-year support and maintenance and offer discounts to customers that upgrade to cloud or Data Center products at lower prices. More details will be revealed in the company’s Q1’21 shareholder letter on October 29, 2020.

In a blog post to customers, TEAM co-founder and co-CEO Scott Farquhar wrote: “When it comes to our mission of unleashing the potential of every team – including yours – you need us to move faster and go even further. In response, we are announcing changes to our server and Data Center offerings in order to sharpen our focus as a cloud-first company.”

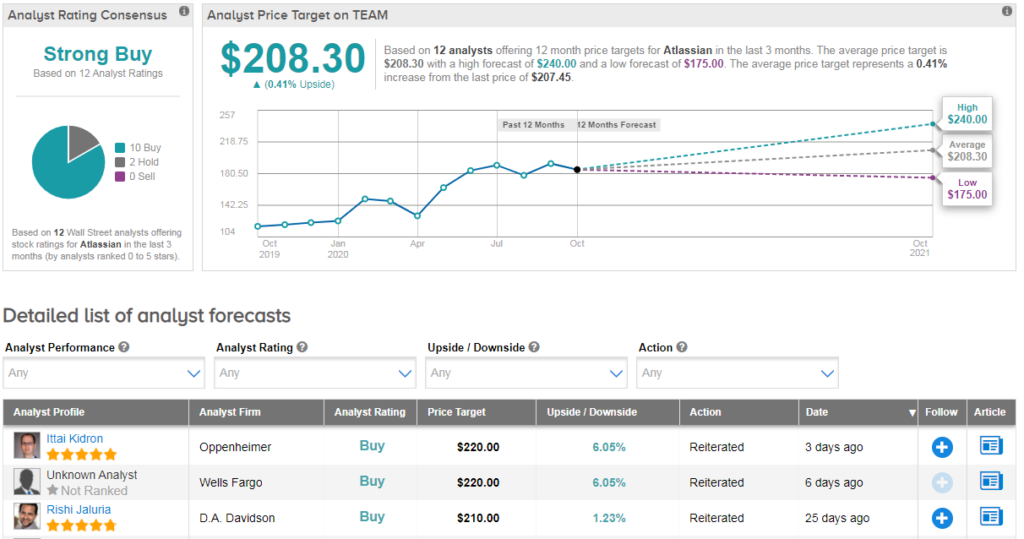

Following the announcement, Oppenheimer analyst Ittai Kidron reiterated his buy rating on the stock and $220 price target.

“Ultimately, the moves signal Atlassian’s efforts to accelerate its customers’ transition to cloud products from on-premise. The company has taken into account this transition in its guidance, and this shouldn’t come as a surprise to investors, but rather as the official start for the “rollover” to the cloud process” he commented.

As a result, the analyst believes that CY21 will be a transitional year, when the major portion of the impact of this transition will be felt before growth can accelerate again.

Longer-term, Kidron expects the discounting effect to generate a tailwind for subscription revenue growth as migrating customers are slowly ramped to full cloud pricing over a few years. (See TEAM stock analysis on TipRanks)

Shares in Atlassian have surged over 70% year-to-date, and the stock scores a bullish Strong Buy Street consensus. That’s with 10 recent buy ratings vs 2 hold ratings. Meanwhile the average analyst price target stands at $208- which is flat with the current share price.

Related News:

GTT In $2.15B Deal To Sell Infrastructure Unit To I Squared; Shares Up 7%

First Citizens, CIT To Merge Into $100B US Regional Lender; Shares Spike

Eli Lilly To Snap Up Disarm In $135M Deal; Street Stays Bullish