Shares of technology-enabled consumer product platform Aterian (ATER) nosedived about 13% during the after-hours session on Monday, after its first-quarter numbers fell short of expectations on both the top-line and bottom-line fronts.

Revenue declined 13.4% year-over-year to $41.67 million, falling short of consensus by $1.14 million. The net loss per share at $0.78 came in wider than estimates by $0.52. Additionally, amid global supply chain challenges, Aterian’s contribution margin dropped to 9.2% from 12.7% in the comparable year-ago period.

Furthermore, due to supply chain constraints, Aterian did not launch any new products during the quarter. In comparison, it had launched 21 products in the year-ago period.

Management Weighs In

The Co-Founder and CEO of Aterian, Yaniv Sarig, commented, “Our efforts to optimize our financial strength and our investments in our team and infrastructure should allow us to weather the unpredictable environment and position us to drive growth both organically and through our accretive M&A strategy as the global supply chain stabilizes.”

The company is focusing on retaining its market share amid the challenging macro environment.

Analysts’ Take

Alliance Global Partners analyst Brian Kinstlinger has reiterated a Buy rating on the stock while decreasing the price target to $4.50 from $9.

Overall, the Street has a Strong Buy Consensus rating on Aterian based on four Buys and a Hold. The average Aterian price target of $6.80 implies a massive 70.4% potential upside for the stock. That’s after a 71% decline in the share price over the past 12 months.

Investors Remain Positive

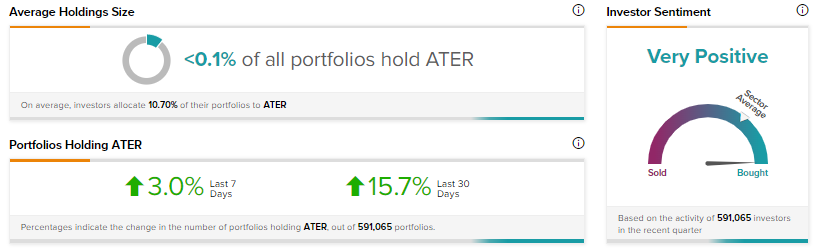

Despite the weaker-than-expected first-quarter performance, investor sentiment remains very positive about Aterian. TipRanks data indicates the number of portfolios holding Aterian has increased by 15.7% in the past 30 days alone.

Closing Note

Persistent supply chain bottlenecks and inflationary challenges could affect Aterian’s performance in the coming periods. Moreover, the stock has been volatile in the recent past, and with a short interest of 39.8%, these gyrations may continue.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Did Shopify Shares Drop 15%?

Boeing Relocates HQ to Virginia; Shares Down 4.1%

Datadog Tanks 6% Despite Q1 Beat & Strong Outlook