AstraZeneca said that additional data from the Phase 3 trial of its Imfinzi treatment showed “unprecedented” survival in unresectable, Stage 3 cell lung cancer with an estimated 50% of patients surviving 4 years.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

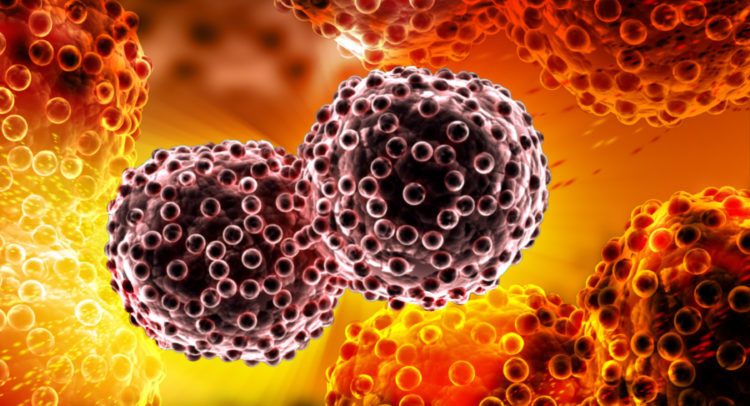

Shares are gaining 2.1% in Friday’s pre-market trading session. According to the results from the Phase 3 trial, AstraZeneca’s (AZN) Imfinzi demonstrated clinically meaningful overall survival (OS) and progression-free survival (PFS) in patients with unresectable, Stage 3 non-small cell lung cancer (NSCLC) who had not progressed following chemo-radiation therapy (CRT). One in three patients with NSCLC are diagnosed at Stage 3, where the majority of tumors cannot be removed with surgery.

Imfinzi is a human monoclonal antibody that binds to PD-L1 and blocks the interaction of PD-L1 with PD-1 and CD80, countering the tumor’s immune-evading tactics and releasing the inhibition of immune responses.

“These unprecedented four-year results reinforce Imfinzi as the established standard of care in unresectable, Stage 3 non-small cell lung cancer and set a new survival benchmark in a setting where cure is the treatment goal,” said AstraZeneca’s José Baselga. “Imfinzi continues to deliver impressive long-term benefits across different types of lung cancer.”

The results from the updated post-hoc analyses showed an estimated 4-year overall survival rate of 49.6% for Imfinzi versus 36.3% for placebo after CRT. Median OS was 47.5 months for Imfinzi versus 29.1 for placebo. With a maximum treatment course of one year, an estimated 35.3% of patients treated with Imfinzi had not progressed 4 years after enrollment versus 19.5% for placebo.

Lung cancer is the leading cause of cancer death among both men and women and accounts for about one fifth of all cancer deaths.

AZN shares have gained 12% this year as the drugmaker joined the list of companies engaged in the development of a potential coronavirus vaccine. The Phase 2/3 study of the AstraZeneca/Oxford vaccine candidate was this month put on hold after an adverse event in a single participant from the UK. (See AstraZeneca stock analysis on TipRanks)

In reaction, SVB Leerink analyst Andrew Berens reiterated a Buy rating on the stock suggesting that the adverse event could have a broader impact and could cause near-term volatility in AstraZeneca’s shares as well as in the stock of other companies with COVID vaccine programs until the exact nature of the event is clear.

As a result, Berens cautions that the overall speed of many of the programs could be affected as the investigation progresses and sponsors become more vigilant, as well as public sentiment regarding the safety of the vaccines once approved.

Overall, the stock scores a Strong Buy consensus from the analyst community with 3 unanimous Buy ratings. Looking ahead, the $91.76 average analyst price target puts the upside potential at a promising 64% in the coming 12 months.

Related News:

Pfizer CEO: Our Covid-19 Vaccine Could Be Ready In US By Year-End

Medtronic’s First-Of-Its Kind Diabetes System For Young Children Approved

Gilead Inks $21B IMMU Deal, Adding Trodelvy To Its Oncology Arsenal