AstraZeneca announced that it has agreed to acquire US drugmaker Alexion Pharmaceuticals in a cash and stock deal worth $39 billion. The Britain-based pharmaceutical company said that the buyout will help expand its presence in the rare disease and immunology drug market.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

AstraZeneca (AZN) CEO Pascal Soriot stated, “Alexion has established itself as a leader in complement biology, bringing life-changing benefits to patients with rare diseases. This acquisition allows us to enhance our presence in immunology. We look forward to welcoming our new colleagues at Alexion so that we can together build on our combined expertise in immunology and precision medicines to drive innovation that delivers life-changing medicines for more patients.”

AstraZeneca will pay $60 in cash and 2.1243 AstraZeneca American Depositary Shares for each Alexion (ALXN) share held. The transaction is likely to complete during the third-quarter of 2021, following which, Alexion shareholders will own a 15% stake in the combined company.

AstraZeneca expects the combined company to “deliver double-digit average annual revenue growth through 2025.” Moreover, the transaction is projected to be immediately accretive to earnings per share, “with double-digit percentage accretion anticipated in the first three years following the completion of the acquisition.” (See AZN stock analysis on TipRanks)

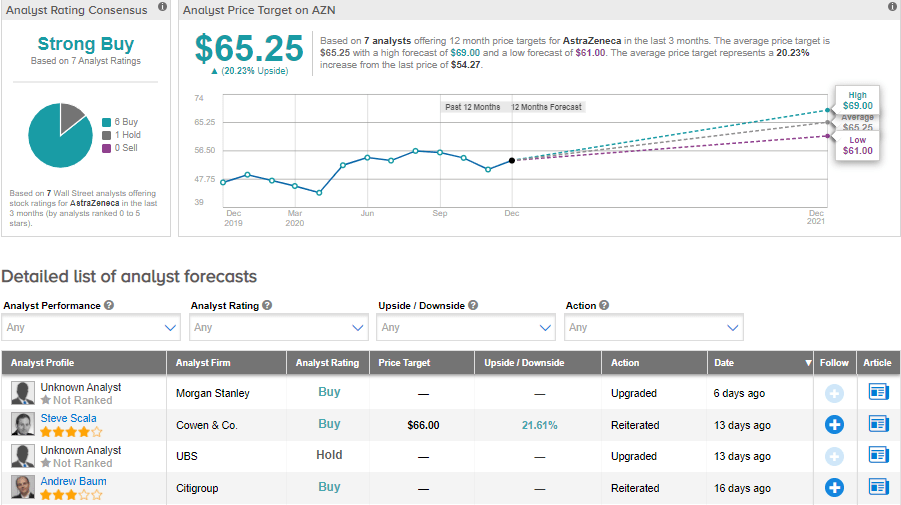

On Nov. 30, Cowen & Co. analyst, Steve Scala reiterated a Buy rating and price target of $66 (21.6% upside potential). In a note to investors, Scala cited AstraZeneca as the “Best Pharma Idea for 2021.” The analyst wrote, “AZN has more important news events in 2021 than most other pharma stocks. This includes: Enhertu Ph III data in HER2-low BC, Farxiga Ph III data in HFpEF, Lynparza Ph III data in adjuvant BC, anifrolumab, roxadustat and COVID-19 vaccine approvals/rollouts, tezepelumab full Ph III data/filings in severe asthma, and Tagrisso approval in adjuvant NSCLC, among others.”

Overall, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 6 Buys and 1 Hold. The average price target stands at $65.25 and implies upside potential of about 20.2% to current levels. Shares have gained 8.8% year-to-date.

Related News:

Pfizer-BioNTech’s Covid-19 Vaccine Wins FDA Panel Vote; Shares Rise

Sanofi-GSK Covid-19 Vaccine Delayed After Elderly Trial Disappoints

Immutep Explodes 63% On Encouraging Breast Cancer Trial Data