AstraZeneca Plc’s (AZN) and Merck Co.’s (MRK) Lynparza drug has received a green light from the U.S. Food and Drug Administration (FDA) for the treatment of patients with advanced prostate cancer.

The FDA approval was awarded following results from a Phase III trial, which found that the Lynparza drug treatment reduced the risk of disease progression or death by 66%.

Prostate cancer is the second-most common cancer type in men and despite an increase in the number of available therapies for men suffering from the disease, five-year survival remains low.

Lynparza is a first-in-class PARP inhibitor, which is a targeted treatment to potentially block DNA damage response (DDR) pathway deficiencies, such as so-called BRCA mutations to kill cancer cells. It is being tested in a range of tumor types. Regulatory reviews are underway in several jurisdictions for ovarian, breast, pancreatic and prostate cancers.

“Today marks the first approval for Lynparza in prostate cancer,” said Dave Fredrickson, Executive VP at AstraZeneca. “In the trial, Lynparza more than doubled the median radiographic progression-free survival and is the only PARP inhibitor to improve overall survival.”

Following this approval for Lynparza in the U.S., AstraZeneca said it will get a regulatory milestone payment of $35 million from MSD Laboratories. The payment is expected to be booked as collaboration revenue in its second-quarter results, the drugmaker said.

In the race for the development of a coronavirus vaccine, the UK-based pharmaceutical drugmaker announced this week that it is hoping to make up to 30 million Covid-19 vaccine doses available by September for people in the UK, as part of an agreement to deliver 100 million doses in total.

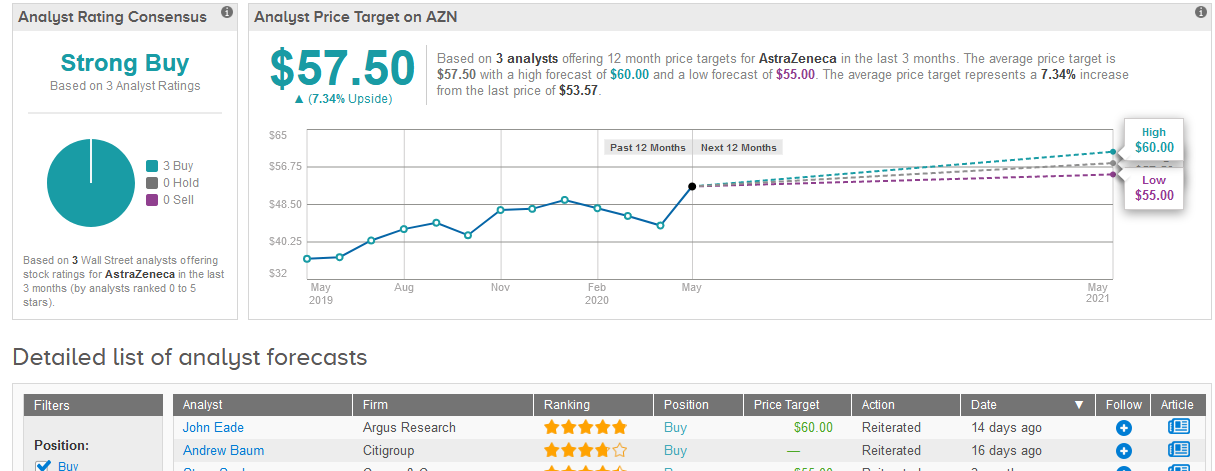

Shares in both AstraZeneca and Merck are advancing in Wednesday’s pre-market U.S. trading. AstraZeneca’s stock has seen a steep increase over the past two months erasing all of this year’s losses and at $53.57 it is now trading higher than at the beginning of the year.

TipRanks data shows that Wall Street analysts have a bullish outlook on the stock boasting only Buy ratings. Following the recent share rally, the $57.50 average price target puts the upside potential at 7.3% in the coming 12 months. (See AstraZeneca stock analysis on TipRanks).

Related News:

Bluebird Prices New Shares At $55, Seeks To Raise $500 Million

Moderna Spikes 21% Amid “Positive” Early-Stage Covid-19 Vaccine Data

AstraZeneca Aiming For 30M UK Covid-19 Vaccine Doses By September