Shares of the British pharmaceutical giant AstraZeneca PLC (GB:AZN) dropped amid the looming risks related to an expanding Chinese probe into accusations of insurance fraud. According to the Chinese news publisher Yicai Global, numerous senior executives at AstraZeneca China have been implicated in an ongoing insurance fraud investigation. AZN stock in London fell 8.4% on Tuesday, experiencing its biggest drop since March 2020.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

AstraZeneca is a leading global pharmaceutical company, serving billions of people worldwide. The company operates in three main categories: Oncology, Rare Diseases, and BioPharmaceuticals.

AZN Executive in China Comes Under Fraud Scrutiny

AstraZeneca disclosed last week that its China head, Leon Wang, is under investigation by local authorities. The company further stated that Wang is cooperating with Chinese authorities in an ongoing investigation.

Reportedly, the investigation into Wang is linked to some AstraZeneca China sales personnel being convicted of fraud for manipulating patient test results to boost drug sales. In April 2021, the company’s representative in Sichuan forged prescriptions and genetic test reports to sell the lung cancer drug Tagrisso through insurance fraudulently.

This probe has sparked concerns over the stability of the company’s sales in China, which is its second-largest revenue market after the U.S. AstraZeneca is relying on growth in China to achieve its goal of $80 billion in annual revenue by 2030 as compared to the $46 billion generated last year.

Mixed Analyst Views on AstraZeneca Stock

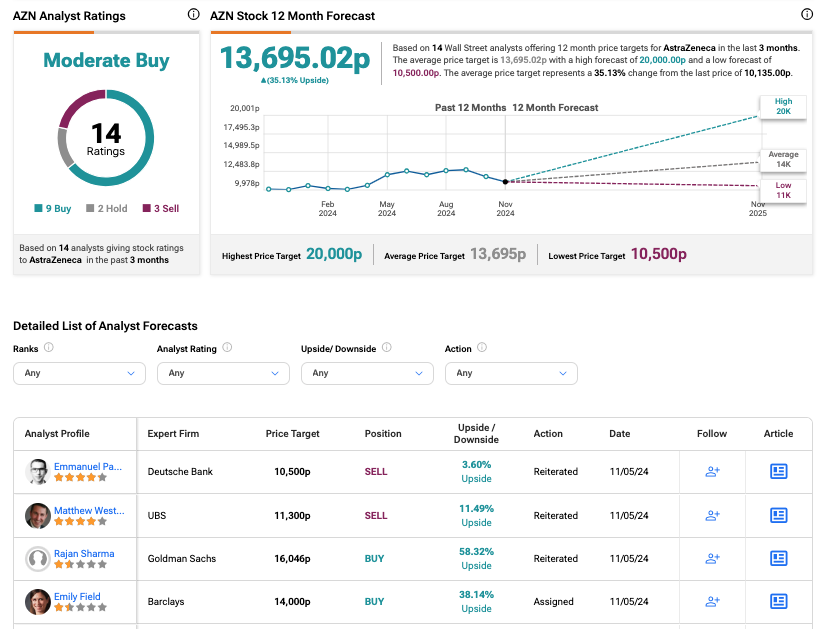

Following the unfavorable news, AZN stock received mixed reactions from analysts. Yesterday, Deutsche Bank and UBS confirmed their Sell ratings on the stock.

On the other hand, Goldman Sachs reiterated a Buy rating, predicting a huge upside of 58.3%. Likewise, Barclays assigned a Buy rating with a forecast of 38% growth in the share price.

Is AstraZeneca a Good Share to Buy?

As per the consensus rating on TipRanks, AZN stock received a Moderate Buy rating, supported by a total of 14 recommendations. The AstraZeneca share price forecast stands at 13,695.02p, which is 35.13% above the current trading level.