While you may never have heard of AST SpaceMobile (NASDAQ:ASTS), those who were already invested in it are sure glad they did today. It’s up over 50% in Wednesday afternoon’s trading thanks to a newly-minted partnership between it and Verizon (NYSE:VZ), which gave investors a whole lot of reason to smile. AST SpaceMobile specializes in providing satellite internet service to mobile devices, particularly phones. It’s already inked a deal to offer service to AT&T (NYSE:T), which will help expand its coverage rate across the United States without having to build a ton of new cell towers.

With this new service, both AT&T and Verizon will be able to claim that dead zones are virtually a thing of the past now, and those remote areas that were previously inaccessible to cell phone coverage now are. The deal calls for Verizon to fork over $100 million, with $65 million in pre-payments and $35 million in convertible note debt. However, $45 million worth of the pre-payments will be subject to “needed regulatory approval” and “signing of a definitive commercial agreement.”

Matching AT&T

This is roughly similar to a deal inked just a couple weeks ago with AT&T, though the numbers on that one were kept a little closer to the vest. In fact, we heard about that deal back when it was inked, and expressed the notion that it could be a challenger to the Starlink system.

Having used the Starlink system for a few months now myself, my only assertion on that is “good luck.” It’s maintained shockingly good uptime and dazzling speeds for a fairly decent price, especially considering that it’s a satellite internet system. But Verizon working with AST SpaceMobile does help ensure that AT&T won’t keep a competitive advantage over it for long.

Is ASTS a Good Stock to Buy?

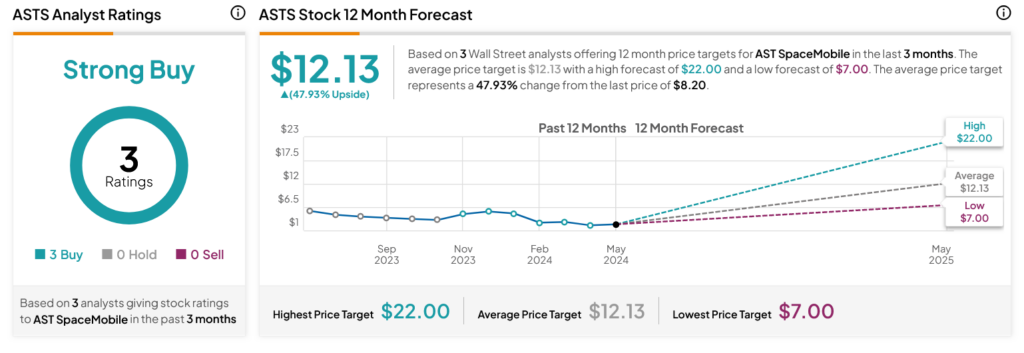

Turning to Wall Street, analysts have a Strong Buy consensus rating on ASTS stock based on three Buys assigned in the past three months, as indicated by the graphic below. After a 54.96% rally in its share price over the past year, the average ASTS price target of $12.13 per share implies 47.93% upside potential.