ASML (NASDAQ:ASML), the Dutch provider of lithography technology for the manufacturing of semiconductor chips, has called for a “reliable government.” This comes after a surprise win for Geert Wilders’ far-right Freedom Party in the Dutch elections.

In a statement emailed to Bloomberg by a spokesperson for ASML, the company has called for a “consistent long-term policy” to help ensure a stable business environment for the tech industry.

Wilders’ chances to lead the government depends on his party’s alliances with center rivals. His party’s surprise win signals a shift in Dutch politics. Wilder has advocated for a referendum on the Netherlands’ participation in the EU and opposes policies on immigration.

This indicated that Dutch companies like ASML, which heavily rely on talent from abroad, could be adversely impacted.

ASML’s spokesperson stated that changes to the country’s fiscal policy “such as the recent further limitation of the 30% ruling for internationals and the levy on share buybacks affect Dutch competitiveness, [and] could have serious impact on ASML and our ability to invest, innovate and attract the workforce we need to be able to continue our growth.”

Last month, the Dutch parliament greenlighted a proposal that would slash the expat tax benefit. This tax benefit exempts 30% of an expat’s salary from income tax for five years. The upper house has not yet approved this proposal, but if approved, the changes will apply from next year.

The spokesperson added that any restrictions placed on “the amount of knowledge workers or international students relevant for our industry are undesirable.”

Is ASML Holding a Good Stock to Buy?

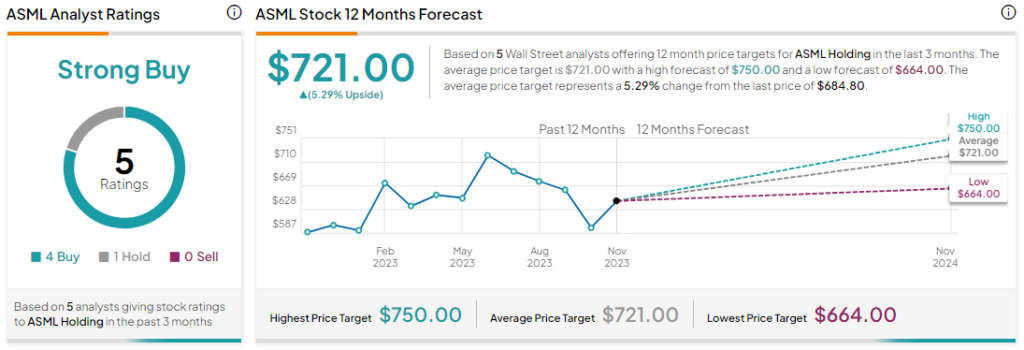

Analysts remain bullish about ASML, with a Strong Buy consensus rating based on four Buys and one Hold. ASML stock has surged by more than 25% year-to-date, and the average ASML price target of $721 implies an upside potential of 5.3% at current levels.