Shares of Asana surged almost 16% in Wednesday’s extended trading session after the software company reported better-than-expected 3Q results. The team-based work management applications provider’s 3Q revenues surged 55% to $58.9 million that surpassed the analysts’ expectations of $54.1 million.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Asana’s (ASAN) 3Q non-GAAP loss per share of $0.34 was smaller than Street estimates of a loss of $0.36. However, the loss widened from $0.30 per share in the year-ago period.

“We reported a very strong quarter, with total revenue growth of 55 percent year over year and growth of revenue from customers who spend $5,000 or more on an annualized basis of over 80 percent year over year,” said Asana’s CEO Dustin Moskovitz.

Moskovitz added, “With the acceleration of digital transformation, organizations are reimagining every aspect of business operations to ensure that people can stay engaged, aligned and effective, no matter where they are. Asana’s Work Graph provides the power, flexibility and control that organizations need to orchestrate work at scale.”

Buoyed by strong quarterly performance, Asana raised its fiscal 2021 revenues guidance range to $220.6-$221.6 million from $210-$213 million. Moreover, the company now projects to report a non-GAAP loss per share in the range of $1.21-$1.24, down from the previous guidance of $1.30-$1.33. (See ASAN stock analysis on TipRanks)

For 4Q, Asana forecasts revenues of between $62 million and $63 million, while non-GAAP loss per share is projected at $0.25-$0.27.

On Oct. 26, Oppenheimer analyst Ittai Kidron initiated coverage on the stock with a Buy rating and price target of $30 (5.9% upside potential). In his report, Kidron wrote, “We believe Asana is poised to benefit as enterprises look for ways to improve workflow and worker productivity, and could see material revenue upside ahead.”

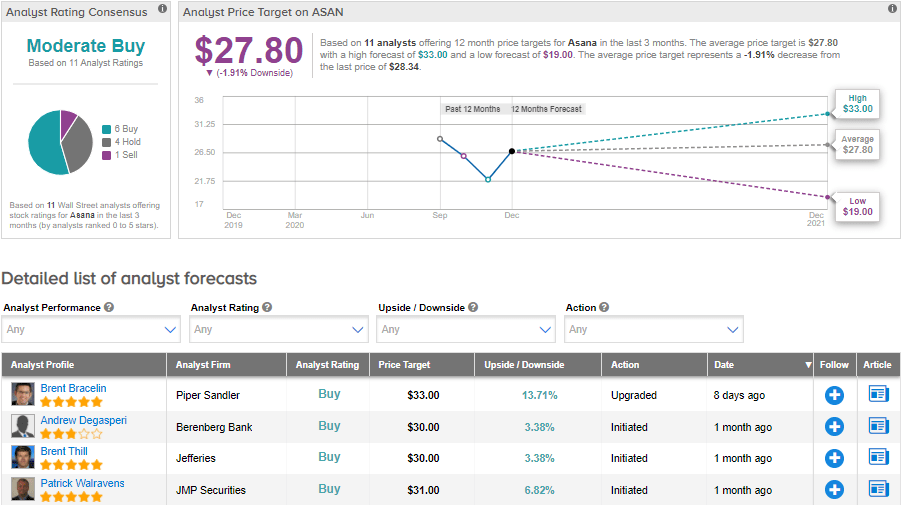

Overall, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 6 Buys, 4 Holds and 1 Sell. The average price target stands at $27.80 and implies downside potential of about 1.9% to current levels. Shares have declined by about 1.6% since their listing on the NYSE on Sep. 30.

Related News:

Phreesia Slips 9% On Wider-Than-Feared 3Q Loss, CFO Departure

AutoZone Drops 5% On 1Q Sales Miss; Street Is Bullish

AeroVironment Buys Telerob For $45.5M, Posts 2Q Profit