Asana (NYSE:ASAN) delivered better-than-expected results for the fourth quarter, driven by an expanding customer base. However, shares of the company declined about 2% in yesterday’s extended trading session.

ASAN is a technology company that provides a web and mobile application designed to help teams organize, track, and manage their work tasks and projects.

Q4 Financial Highlights

The company reported an adjusted loss of $0.04 compared with a loss of $0.15 in the year-ago quarter. Also, it compared favorably with the consensus estimate of $0.1 per share. Similarly, revenues of $171.1 million increased 14% year over year and surpassed the Street’s estimate of $167.7 million.

Importantly, the number of core customers, or customers spending $5,000 or more on an annualized basis, climbed to 21,646, up 11% year over year. Moreover, customers spending $100,000 or more increased by 20% during the quarter. Also, the overall dollar-based net retention rate remained above 100%.

Q1 and Fiscal 2025 Outlook

The company expects Q1 revenues to be in the range of $168 million to $169 million, compared with consensus estimates of $168.25 million. Moreover, the company predicts that adjusted loss will come in between $0.08 and $0.09 per share, in line with the Street’s expectations of $0.08 per share.

For the full Fiscal Year 2025, ASAN anticipates that revenue will fall between $716 million and $722 million, and adjusted losses will remain in the range of $0.19 to $0.22 per share.

Is Asana a Good Stock to Buy?

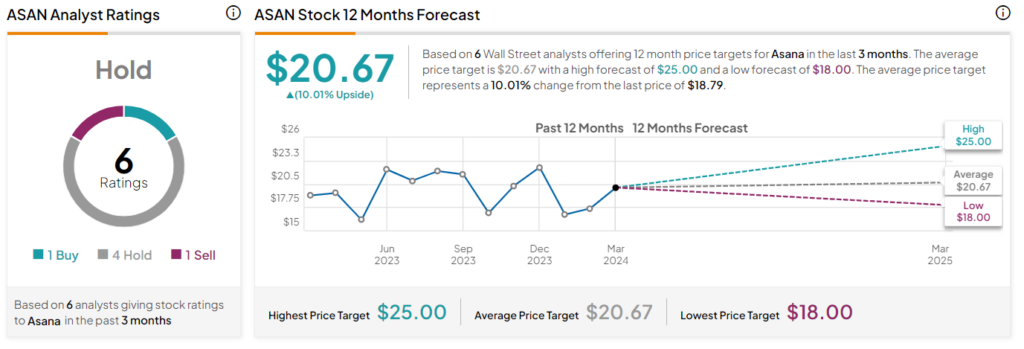

Overall, Asana has a Hold consensus rating based on one Buy, four Hold, and one Sell recommendation. The analysts’ average price target on ASAN stock of $20.67 implies a 10% upside potential to current levels. The stock is down 9% over the past year.