ZIM Integrated (ZIM) is a shipping company that offers international and domestic shipping services. It is the largest shipping company in Israel and one of the leading cargo transport companies.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

ZIM’s international services include the transportation of general cargo, heavy equipment, bulk liquids, project cargoes, and containers. Domestic services include the transportation of general cargo, project cargoes, and containers.

Shipping stocks have been under pressure for some time now. The pressure on the industry is coming from all sides. However, ZIM is a rare shipping company that keeps growing at a very healthy pace.

We saw an increase in revenue of 113% in the latest quarter. The growth is largely due to the sharp increase in shipping rates, leading to a rise in the average freight rate. Meanwhile, the financial stats are really looking good. Net income increased by 190% to reach $1.7 billion on $3.7 billion in revenue.

Despite the excellent growth, ZIM Integrated is down overall in the year thus far. Hence, you are getting the opportunity to purchase a great business at a steep discount. The shipping giant is also a much more modern and innovative shipping company. They want to emphasize things like digitalization and newer concepts, which can be difficult for a traditional shipping company anchored in the past. Investors in search of stability might want to add ZIM to their portfolios.

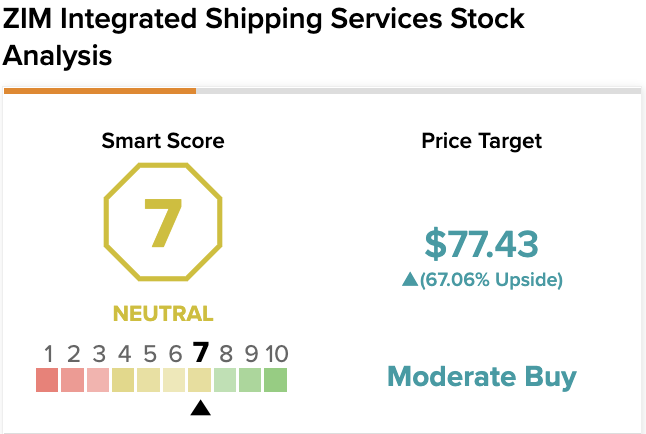

On TipRanks, ZIM scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

The Bull Case for Owning ZIM Integrated Keeps Increasing

As of April, ZIM Integrated (the largest shipping company in Israel) had 127 ships with a total capacity of 460,000 twenty-foot equivalent units (TEU); only 8 of those ships were owned by the company, while 119 were chartered.

ZIM Integrated offers its customers air freight forwarding, ocean freight forwarding, and land transportation services. It also provides warehousing and distribution services to companies around the world. ZIM Integrated offers a variety of logistics solutions, such as customs clearance and documentation services for international trade.

Last year was quite the rollercoaster ride for those involved in shipping goods across the oceans. A shortage of labor and an increase in ecommerce led to exorbitantly high shipping costs. Add sky high oil prices to the mix and you get a perfect (and expensive) storm. Equity markets are expected to stabilize eventually, but ZIM Integrated will remain a relatively affordable stock. It’s worth it for the generous dividend alone.

The shipping company has a great dividend policy. As for the dividend, management will naturally trim it as profitability starts to contract. However, it’s still going to remain sizable. This year, ZIM has shifted to a quarterly payout policy and varied it depending on earnings. It aims to distribute 20% of each quarter’s earnings as dividends and at least 30% of the full year’s earnings.

When investing in international stocks, it is always important to consider that they are inherently riskier than domestic stocks. Most freighter firms are highly volatile and cyclical, and their bottom line is often unpredictable. For example, a carrier might be struggling with high gas prices one year but see a boom in demand the following year.

What are the Risks?

Shipping stocks are usually not very popular with investors. However, it is very difficult to understand the importance of marine shipping and the global economy if you don’t experience it firsthand.

The economic slowdown following the worldwide pandemic has severely affected worldwide supply chains. This has left deep-sea cargo ships and containers out of position to handle a surge in demand from consumers unable to purchase things.

As the pandemic diminishes, Russia’s invasion of Ukrainian territory has threatened to disrupt trade and cargo routes. Potential disruptions in trade are affecting both economic conditions as well as global supply chains.

However, these conditions are temporary phenomena. Once these issues subside, profits will normalize, and posing as a risk for ZIM.

In addition, the shipping industry is a very lucrative one, but it’s also one that’s highly volatile. Different forces play into the volatility in shipping stocks, one of them being the loans companies take out to buy ships. It’s good that ZIM has been able to make some profits recently, because it currently has a significant amount of debt; which increased by approx. $1 billion from the end of Q4 2021 to $4.3 billion.

These factors are important to keep in mind when investing in this space.

Wall Street’s Take

Street sentiment on ZIM Integrated is bullish, suggesting that the stock has strong growth prospects. It has a Moderate Buy consensus rating on the back of two Buys and one Hold.

ZIM has an average price target of $77.43 per share implying 67.06% upside.

The Bottom Line on ZIM Integrated

ZIM Integrated Shipping Services has continued to grow over the past few years by expanding its operations, investing in new technologies, and improving customer service. The company has also made significant investments in its fleet to meet the growing global trade demand. These investments have resulted in the company offering competitive prices for both ocean and air freight services.

The COVID-19 pandemic and subsequent events lead to massive tailwinds for the shipping giant. However, despite a sharp increase in profits, the stock trades at a massive discount. It gives you a serious incentive to invest in these multiples and purchase a quality business, cheaply.

Read full Disclosure