You can potentially chase the controversy in the so-called censorship-free video content platform Rumble (NASDAQ:RUM) and do well. Recently, politically conservative voices have proven to be an organized and powerful force that can influence the capital market. However, the near-term appeal clashes with longer-term concerns. I am neutral on RUM stock based on a “split” narrative, which I’ll explain below.

RUM Stock Runs on Right-Wing Fuel

Generally speaking, Americans’ attitudes and behaviors have become more liberal over the past half-century, according to New York University. In particular, the academic institution states that “Americans are substantially more liberal on matters of gender, sexuality, race, and personal liberty than they were in the 1970s.” However, the right wing still represents an unignorable element in society that cannot be taken for granted.

Sure, headlines tend to broadcast concerns that liberal activists forward. For example, early last year, TipRanks contributor Steve Anderson mentioned the plight of PepsiCo (NASDAQ:PEP). As it so happened, the beverage maker committed the “mistake” of donating to the Texas arm of the Republican Party. Calls for product boycotts quickly sprouted, particularly because PepsiCo indirectly supported contentious issues.

On paper, such narratives wouldn’t organically help RUM stock. However, conservative groups and advocates can also punch above their weight. That was plainly evident when various right-wing voices called for a boycott of the Anheuser-Busch (NYSE:BUD) brand Bud Light. At the time, Bud Light inked a one-off promotional campaign with social media influencer Dylan Mulvaney, who documented her gender transition on TikTok.

Stated differently, while the U.S. has broadly leaned left, this framework also sparked pushback from opposing views. Based on the recent Bud Light uproar, conservative consumers have a significant pull. Therefore, RUM stock enjoys positive extrinsic fundamentals.

Rumble’s Longer-Term Prospects are Questionable

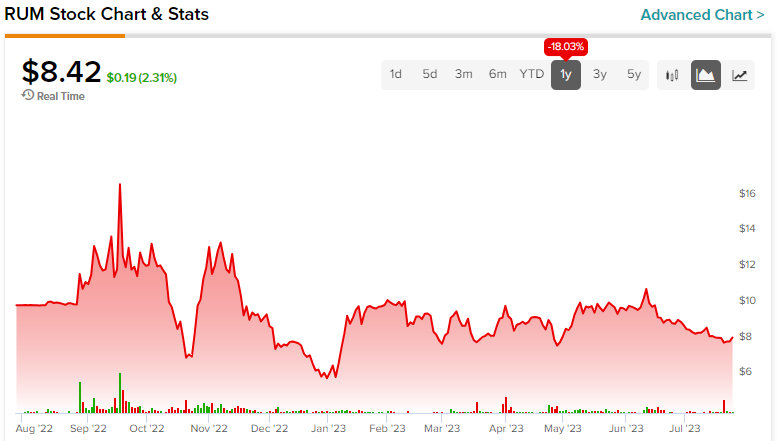

In all fairness, while RUM stock presents a choppy canvas, it can easily swing higher based on near-term catalysts. After all, shares gained over 30% since the start of this year. However, it’s the longer-term picture that raises skepticism for politically-agnostic investors.

Nonetheless, the current options chain readout for contracts with an expiration date of July 28 generally features higher volume and open interest statistics for calls. Call options represent financial contracts that give the buyer the right but not the obligation to acquire the underlying stock or asset.

For instance, call options for the $8.50 strike price had a volume of 73 contracts against an open interest reading of 2,019. On the other end of the equation, puts for the same strike saw a volume of four contracts against an open interest of 202.

While near-term activity may favor the bullish argument of RUM stock (more calls being traded than puts), a controversial platform like Rumble will almost certainly have difficulty attracting advertisers. Due to modern social sensibilities and sensitivities, it’s less likely for businesses to associate themselves with controversial platforms, as it doesn’t align with their strategic interests.

To be 100% fair, Rumble’s terms and conditions of use explicitly forbids violence and racist and prurient materials, among other categories. Still, it doesn’t take much to discover content that’s on the absolute fringes of general acceptability. Frankly, would-be advertisers probably won’t want to take the risk.

The Financials Tell the Tale

Even with the financials, RUM stock presents a conflicting dichotomy — near-term upside potential clashing with longer-term concerns. For example, Rumble posted revenue of $17.62 million in the first quarter of 2023. That’s up more than 4x against the year-ago sales tally of $4.04 million. However, it’s unlikely that any company can maintain such a massive growth track.

Longer term, investors are more likely to focus on the company’s revenue multiple of 44.5. If you consider that the internet software industry runs a price-sales ratio of 5.6x, the premium for RUM stock is simply stratospheric.

More to the point, it’s risky to carry such a multiple for a contentious and controversial platform. Therefore, speculators likely need to hit and run with Rumble if they participate at all.

Is Rumble Stock a Buy, According to Analysts?

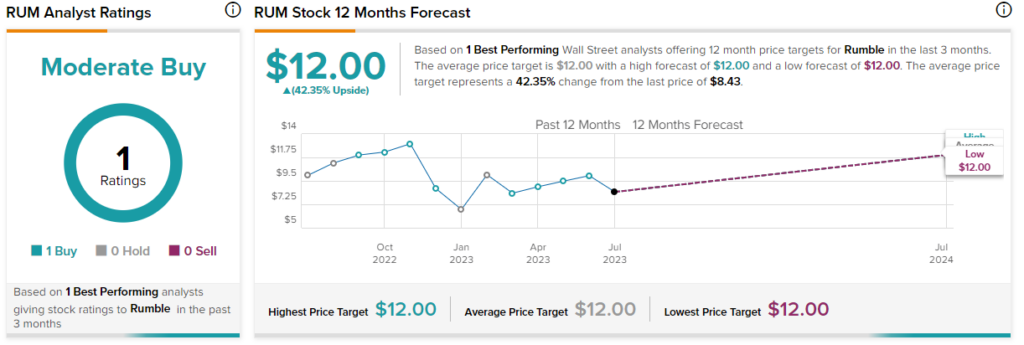

Turning to Wall Street, RUM stock has a Moderate Buy consensus rating based on just one Buy rating assigned in the past three months. RUM stock’s price target is $12.00, implying 42.35% upside potential.

The Takeaway: RUM Stock Has a Short Time Window

Undeniably, the power and influence of the conservative movement undergirds investments like RUM stock, and near-term rumblings suggest that it’s possible RUM shares can swing higher. However, the longer-term concerns arguably outweigh making Rumble a true buy-and-hold investment.