The recent Chinese government crackdown on ride hailing service Didi is just the latest example of the authorities flexing its muscles and reminding China’s tech platforms who’s boss. The show of strength, however, could deter international investors from putting money into Chinese stocks, making them too much of a risky proposition for many.

In contrast, however, Deutsche Bank’s Edison Yu notes one segment which appears to be the recipient of plenty of backing from the Chinese authorities.

“Unique to electric vehicles,” Yu said, “We see continued strong government support both at central and local level due to the creation of manufacturing jobs, the promotion of a cleaner environment, and the desire to export to foreign markets. Ultimately, the government is striving to be a global leader in EV technology across the entire value chain.”

Which is good news for the rising stars of the Chinese EV industry, including XPeng (XPEV).

In fact, Yu cites the growing opportunity in Chinese EV stocks – emerging as “one of the most reliable/safe secular growth sectors” – as a reason why XPEV shares are worthy of a new price target. The figure moves up from $43 to $50, suggesting room for a 15.5% uptick over the coming months. Yu’s rating remains a Buy. (To watch Yu’s track record, click here)

But that’s not the only reason for the new target.

The company also completed its Hong Kong primary listing earlier this month, raising over 13 billion RMB (~$2 billion) in the process. And looking ahead to Xpeng’s upcoming Q2 earnings (most likely in early-mid August), Yu sees “upside from higher volume.”

The analyst expects sales of 3.79 billion RMB, above the consensus estimate of 3.31 billion, gross margin of 10.9%, which is “slightly above” the Street’s forecast and EPS of (1.07) – consensus has (1.22).

For Q3, Yu anticipates XPeng will guide for at least more than 18,000 units – above the already announced 17,398 units sold in Q2 – and revenue of more than 4 billion RMB. Assuming higher P7 and P5 deliveries, the analyst also increased the full-year volume forecast by 5,000 to 75,000 units.

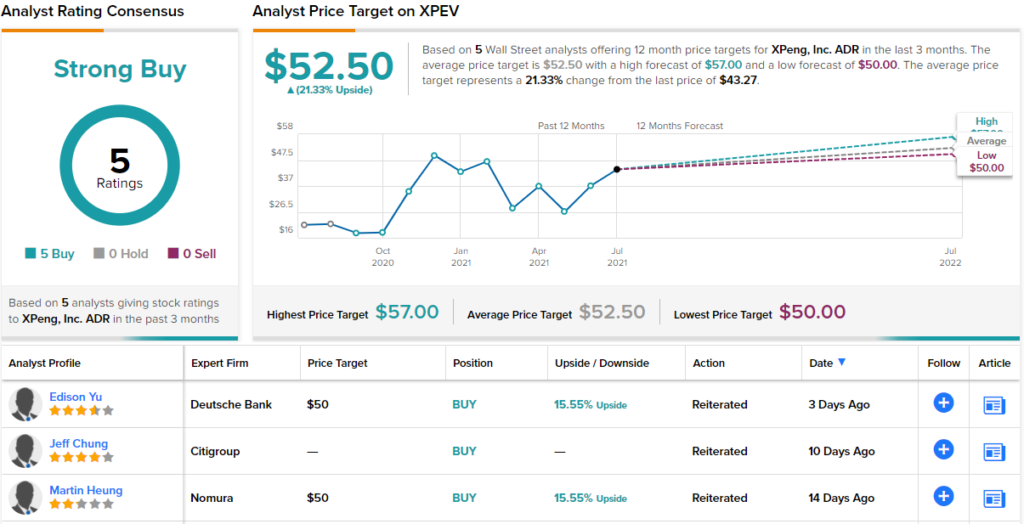

Yu’s confident take is no anomaly; based on Buys only – 5, in total – the stock has a Strong Buy consensus rating. The average price target is just a touch above Yu’s; at $52.50, the figure suggests one-year upside of ~21%. (See XPEV stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.