Wizz Air (GB:WIZZ) announced its trading update on Monday as the company cancelled 5% of its scheduled summer flights.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company is struggling to meet demand due in part to strikes and staff shortages, which have led to cancellations, and flight delays at major European airports.

The share price of Wizz Air fell 4.6% in the wake of the announcement. The stock is already trading 62% down year-to-date (YTD).

Other players in the industry are also facing issues due to the strikes. Another low-cost carrier, Ryanair Holdings’ (GB:RYA) pilots and crew are on also strike in Spain, followed by more strikes planned in Italy, Belgium, and France in the later part of July.

Wizz Air Holdings is one of the leading budget airlines in central and eastern Europe.

More troubles expected; outlook still profitable?

The company’s net losses are expected to be €450 Million for the first quarter of Financial Year 2023. The company also reported an operating loss of €285 Million due to rising fuel costs and other disruptions. Wizz Air also faced €136 Million in foreign exchange losses due to the strengthening of US dollar against Euro.

Despite the short-term factors impacting the results, the company is expecting operational profit in the second quarter of FY 2023 because of higher ticket prices and increased passenger volumes.

View from the city

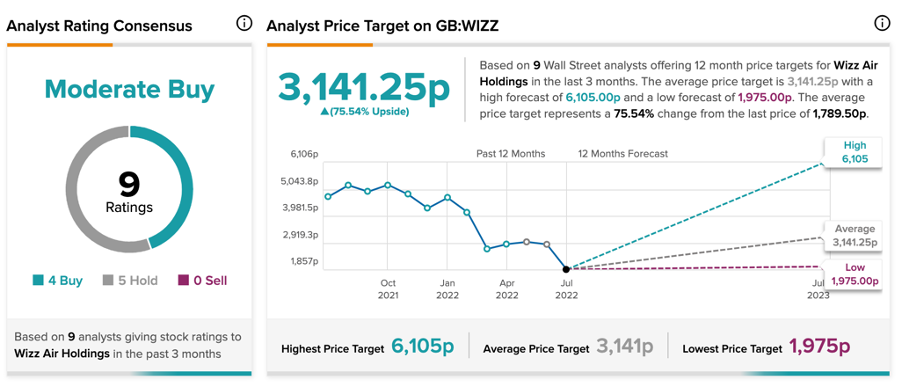

According to TipRanks’ analyst rating consensus, Wizz Air stock has a Moderate Buy rating based on five Hold, and four Buy recommendations.

The average price target is 3,141.25p, which implies upside potential of 75.5%. The analyst price target has a high and low forecast of 6,105.0p and 1,975.0p, respectively.

Conclusion

The recent turmoil in the European airline industry is dampening the post-COVID bounce-back. Wizz Air was hoping to boost its passenger volumes and profitability in the summer season from July to September. However, crew strikes and rising oil prices have disrupted the plans for the airline. The issues will remain prominent in the short term.