An old Warren Buffett quote said that price is what you pay, but value it what you get. Salesforce (CRM) stock isn’t low in price, but that doesn’t mean it’s not a great value.

Sometimes, stocks are expensive because they’re making all the right moves and therefore have earned their share prices. CRM stock fits into that category, as cloud-based customer relationship management is an essential niche market as more businesses choose to digitize and automate.

Moreover, Salesforce’s imminent acquisition of a notable workplace communication tool will add even more shareholder value. (See Salesforce stock chart on TipRanks)

A Quick Look at CRM Stock

In March of 2020, during the onset of the Covid-19 pandemic, CRM stock slid all the way down to the $130’s.

The stock staged an impressive turnaround, however. By early September, CRM stock reached a 52-week high of $284.50. It’s difficult to sustain a vertical price move, though, so Salesforce stock was destined to cough up much of its gains.

A virtual roller coaster ride ensued throughout the remainder of 2020 and into the first half of 2021. Still, much of the damage was mitigated, with CRM stock trading near $246 on June 24.

Notably, CRM stock has a trailing 12-month price-to-earnings ratio of 44.54. That’s another indicator that Salesforce stock isn’t cheap.

Then again, price is what you pay and value is what you get. So, CRM stock’s high price may be justified.

Becoming Slack-First

Slack (WORK) provides an online chat tool that facilitates communication between workers. The value of this type of tool is evident in the wake of the COVID-19 pandemic.

Within the next few months, Salesforce is expected to acquire Slack. This deal, which was announced in late 2020, will be worth $27.7 billion. That’s a lot of money to pay for Slack, but CRM’s shareholders are betting that Slack will be worth the cost.

Salesforce CEO Marc Benioff recently asserted that the Slack acquisition will help Salesforce to become “a key leader in the future of work.”

Benioff even stated that Salesforce is going to rebuild all of its technology to “become Slack-first.”

“Well, if you’re going to be successful from anywhere, you’re going to need an incredible platform like Slack,” Benioff added.

Benioff is making a valid point here. Reportedly, the integration with Slack improved Salesforce’s Service Cloud case close rate by 26%. So, the results are already quantifiable.

Better-Than-Expected Results

Speaking of quantifiable data, Slack recently reported its fiscal results for the first quarter of 2021. Those results were better than what Wall Street had expected.

The analyst community was bracing for quarterly sales of $267.1 million. Yet, Slack’s actual result was $273 million, or 8 cents per share. Furthermore, that result easily beats the year-ago quarter’s sales of $201.7 million, which translated to a loss of 2 cents per share.

In addition, Slack reported having 169,000 paid accounts for the first quarter of 2021. The company had only been expected to report slightly fewer than 156,000 paid accounts for the quarter. (See Slack stock chart on TipRanks)

Slack co-founder and CEO Stewart Butterfield further added that in the first quarter, Slack saw “a near-record number of Paid Customer additions, a record number of Paid Customers adopting Slack Connect, and approached 1 million active developers on our platform.”

With all of that in mind, it’s safe to conclude that Salesforce is making the right decision in acquiring Slack in 2021.

Wall Street Weighs In

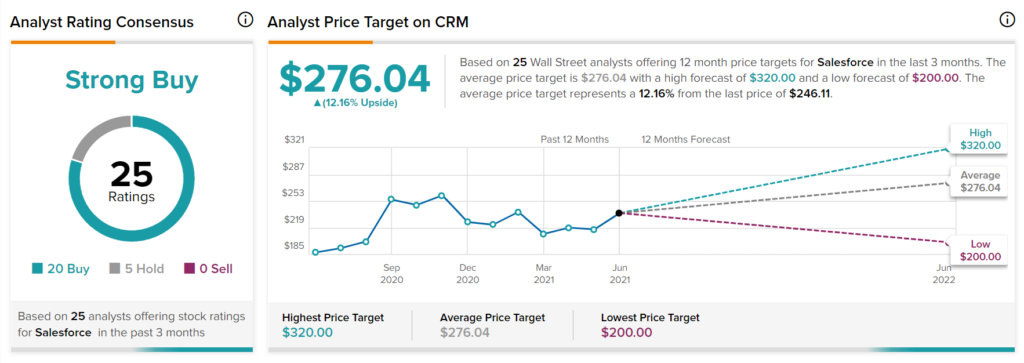

According to TipRanks’ analyst rating consensus, CRM is a Strong Buy, based on 20 Buy and 5 Hold ratings. The average Salesforce analyst price target is $276.04, implying 12.2% upside potential.

The Takeaway

CRM stock isn’t necessarily cheap, but that shouldn’t be a deal breaker for investors.

The Slack acquisition will only add value to Salesforce, which was already a compelling business.

Disclosure: At the time of publication, David Moadel did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.