Smith & Wesson (NASDAQ:SWBI) is slated to release its Q1 Fiscal 2023 (ended July 31) results on September 8, after the closing bell. Going by the company’s history of reporting weak Q1 results and the current economic trends, it looks like SWBI could fall short of Street’s expectations in the quarter.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

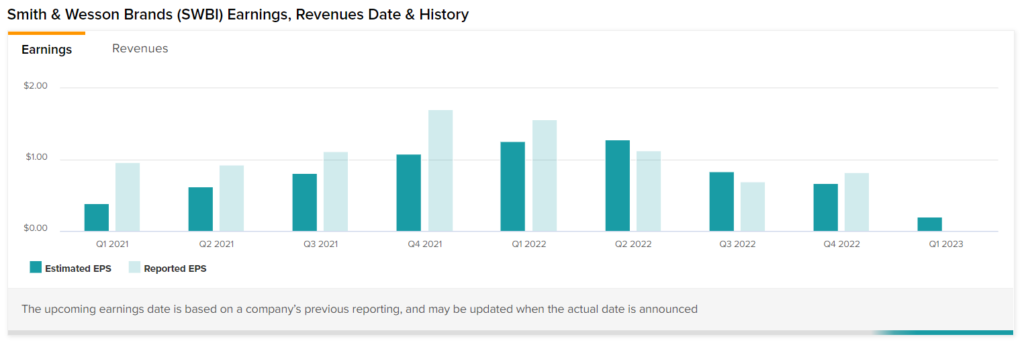

The company primarily designs, manufactures, and markets firearms and offers a complete range of emergency preparedness solutions. Over the past eight quarters (two years), SWBI has floundered in two quarters, missing earnings estimates in Q2 and Q3 of Fiscal 2022.

Factors That May Have Influenced SWBI’s Q1 Performance

The consensus estimate for earnings per share for the quarter stands at $0.21, which suggests a year-over-year decline of almost 87%.

During the last reported quarter, SWBI delivered an earnings surprise of 22%. The company has also been consistently improving its operating cash flow for the past two quarters. The deleveraged balance sheet is expected to have supported this momentum in the to-be-reported quarter as well.

The company’s strategy to streamline business operations to achieve more flexibility and save costs is driving significant margin expansion, which might have been a bottom-line driver.

However, historically, Q1 has been the slowest quarter for the company. Even though volumes are expected to pick up during the hunting (Q2) and holiday seasons (Q3), they are expected to have been low in the to-be-reported quarter.

Not to mention, the impact of rising inflation on people’s spending power could also get reflected in the company’s Q1 results.

Moreover, the FBI’s National Instant Criminal Background Check System (NICS), which is accepted as a proxy for consumer firearm demand, dropped 4.5% in July. This may have been a major headwind in Q1.

Is SWBI a Good Stock to Buy?

In the past three months, only one analyst has reiterated a Buy rating on SWBI stock, leading to a Moderate Buy consensus rating. SWBI’s average price target of $26 reflects 93.16% upside potential.

Final Thoughts

With years of operations, the company dominates the consumer firearm market. Considering its continued efforts to streamline its operations and survive various market cycles, SWBI stock looks lucrative at current levels. Prospective investors could consider buying this stock, which has lost 24.7% so far this year.