Chip giant (NASDAQ:NVDA) is gearing up to release its Q3 Fiscal 2024 financial results on November 21. This prompts the question: Is Nvidia stock set to soar even higher following the quarterly result? While no one can forecast that with absolute certainty, analysts express optimism ahead of Q3 earnings. Street expects NVDA will exceed the already lofty estimates, potentially driving an additional increase in its stock value.

With this background, let’s understand what factors could boost NVDA stock.

Factors Supporting NVDA Stock

The rally in Nvidia stock is driven by the enormous demand for AI (Artificial Intelligence), with NVDA holding a dominant position in this domain. Consequently, investors will look at NVDA’s management to ensure that the AI market and demand are rapidly growing, offering a multiyear growth opportunity. Addressing this, Wolfe Research analyst Chris Caso said there is already evidence of sustained high demand for NVDA’s AI offerings.

Citing Nvidia’s introduction of the H200 GPU at the SC23 event, Caso said that Nvidia has traditionally not refreshed its previous Data Center GPUs. He interprets this announcement as additional evidence of NVDA accelerating its product development cycle in response to the growing AI market and evolving performance requirements. The analyst assigned a Buy rating to Nvidia stock on November 13. Further, he has a price target of $630, representing about 25% upside potential from current levels.

Along with the solid AI-led demand, Nvidia is expected to surpass analysts’ Q3 predictions and offer guidance that exceeds expectations. Susquehanna analyst Christopher Rolland expects much stronger Q3 results and forward guidance from Nvidia. Expressing optimism about NVDA stock, Rolland raised the price target from $600 to $625 on November 16. He noted that the company is aggressively increasing its supply to meet the heightened demand. Moreover, he highlighted that Nvidia foresees this growth continuing each quarter throughout the next year.

What is the Prediction for Nvidia Stock?

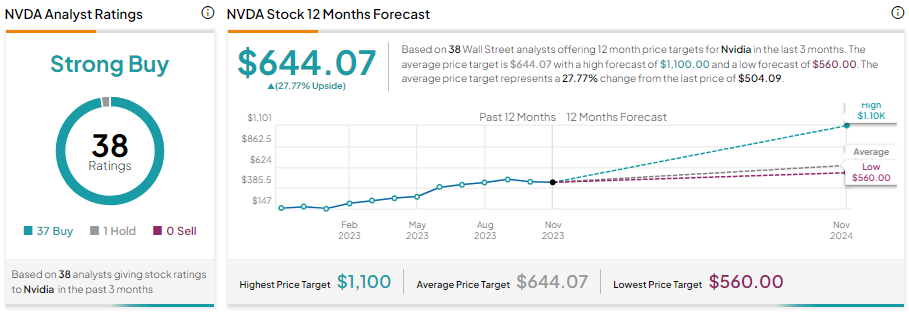

With 37 out of 38 analysts recommending a Buy, Nvidia stock has a Strong Buy consensus rating. Further, the average NVDA stock price target of $644.07 implies an upside potential of 27.77% from current levels over the next 12 months.

Bottom Line

Nvidia’s leadership in the AI space, improved supply chain and product ramp-up, and strength in the Data Center and Gaming segments provide a solid foundation for future growth. This is reflected in analysts’ optimistic outlooks on NVDA stock.